- Foreign exchange market. Asian session: the Japanese yen dropped against the U.S. dollar after the Bank of Japan’s interest rate decision

Notícias do Mercado

Foreign exchange market. Asian session: the Japanese yen dropped against the U.S. dollar after the Bank of Japan’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence October -1 -2

00:30 Australia Producer price index, q / q Quarter III -0.1% +0.2%

00:30 Australia Producer price index, y/y Quarter III +2.3% +2.6% +1.2%

00:30 Australia Private Sector Credit, m/m September +0.4% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y September +5.1% +5.4%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y September -12.5% -17.1% -14.3%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September +1.5% Revised From +2.5% -1.0% -3.2%

07:00 Germany Retail sales, real unadjusted, y/y September -0.7% Revised From +0.1% +1.2% +2.3%

07:45 France Consumer spending September -0.9% Revised From +0.7% -0.5% -0.8%

07:45 France Consumer spending, y/y September +1.4% +0.2%

10:00 Eurozone Unemployment Rate September 11.5% 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October +0.3% +0.4% 0.4%

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by yesterday's U.S. gross domestic product. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The New Zealand dollar traded mixed against the U.S. dollar after the weak building permits data from New Zealand. The number of building permits in New Zealand dropped a seasonally adjusted 12.2% in September, after the flat reading in August.

The kiwi was supported by news that the Chinese government is lifting the temporary suspension for export of Fonterra powder products.

The Australian dollar declined against the U.S. dollar after the release of Australian producer price index and private sector credit. Australia's producer price index (PPI) rose 0.2% in the third quarter, after a 0.1% decline in the second quarter.

On a yearly basis, Australia's PPI increased 1.2% in the third quarter, missing expectations for a 2.6% rise, after a 2.3% gain in the second quarter.

Private sector credit in Australia climbed 0.5% in September, beating expectations for a 0.4% rise, after a 0.4% increase in August.

On a yearly basis, private sector credit in Australia rose 5.4% in September, after a 5.1% gain in August.

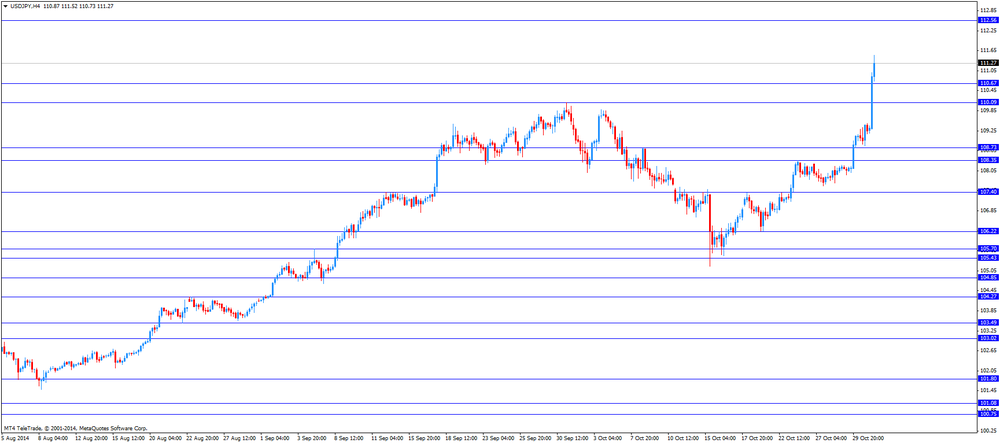

The Japanese yen dropped against the U.S. dollar after the Bank of Japan's interest rate decision. The Bank (BoJ) decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

News that the Japanese government approved plans by the Government Pension Investment Fund to raise the holding of foreign stocks to 25% from 12% also weighed on the yen.

Japan's national consumer price index (CPI) rose 3.2% in September, exceeding expectations for a 3.0% gain, after a 3.3 increase in August.

Japan's national CPI excluding fresh food increased 3.0% in September, in line with expectations, after a 3.1% rise in August.

Tokyo's CPI climbed 2.5% in October, after a 2.9% rise in September.

Tokyo's CPI excluding fresh food gained 2.5% in October, in line with expectations, after a 2.6% increase in September.

Household spending in Japan dropped at annual rate of 5.6% in September, missing forecasts of a 4.0% decrease, after a 4.7% fall in August.

Japan's unemployment rate rose to 3.6% in September from 3.5% in August, in line with expectations.

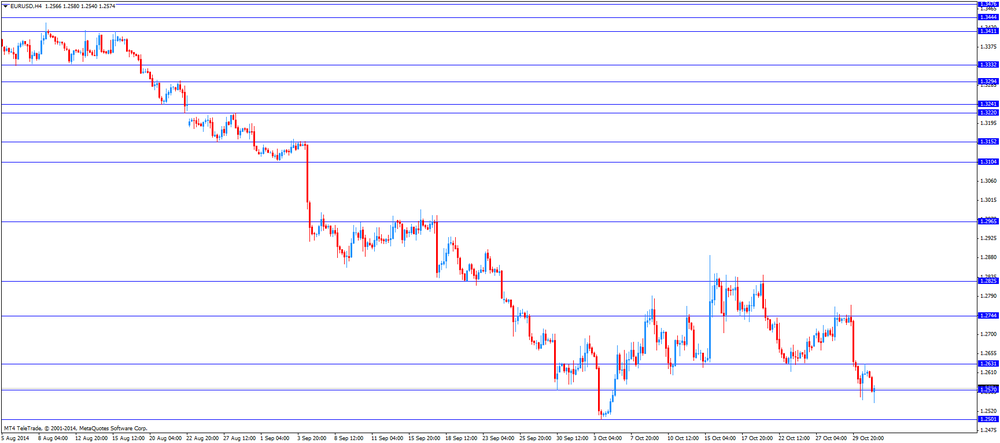

EUR/USD: the currency pair declined to $1.2558

GBP/USD: the currency pair fell to $1.5961

USD/JPY: the currency pair rose to Y111.21

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) August 0.0%

12:30 U.S. Employment Cost Index Quarter III +0.7% +0.5%

12:30 U.S. Personal Income, m/m September +0.3% +0.3%

12:30 U.S. Personal spending September +0.5% +0.1%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.5%

13:45 U.S. Chicago Purchasing Managers' Index October 60.5 59.5

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 84.6 86.4