- Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data

Notícias do Mercado

Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 U.S. FOMC Member Mester Speaks

00:30 Australia RBA Monetary Policy Statement

06:45 Switzerland Unemployment Rate October 3.2% 3.2% 3.2%

07:00 Germany Current Account September 10.3 22.3

07:00 Germany Industrial Production s.a. (MoM) September -3.1% Revised From -4.0% +2.1% +1.4%

07:00 Germany Industrial Production (YoY) September -2.8% -0.1%

07:00 Germany Trade Balance September 17.5 18.3 18.5

07:45 France Trade Balance, bln September -5.8 -5.2 -4.7

07:45 France Industrial Production, m/m September -0.2% Revised From 0.0% -0.1% 0.0%

07:45 France Industrial Production, y/y September -0.3% -0.3%

08:00 Switzerland Foreign Currency Reserves October 462.2 460.4

08:15 Switzerland Retail Sales Y/Y September +1.4% Revised From +1.9% +2.2% +0.3%

09:30 United Kingdom Trade in goods September -9.0 Revised From -9.1 -9.4 -9.8

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to remain unchanged at 5.9% in October. The U.S. economy is expected to add 229,000 jobs in October.

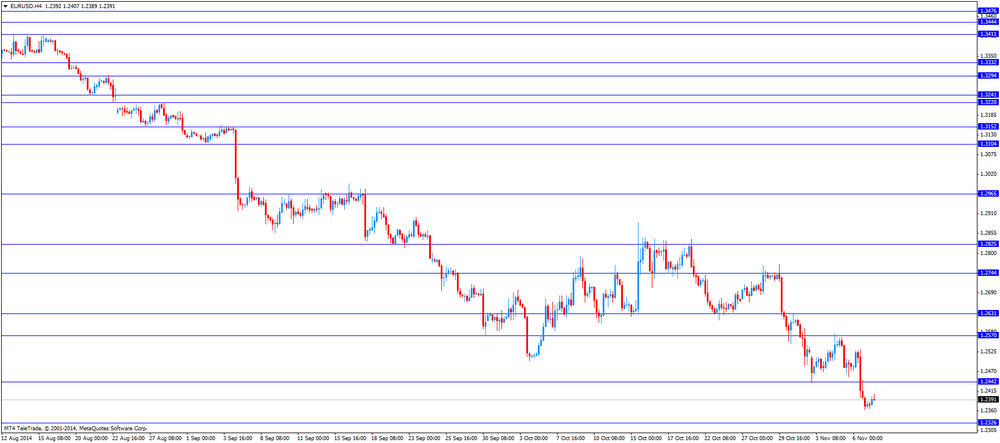

The euro traded higher against the U.S. dollar after the mostly better-than-expected economic data from the Eurozone. Germany's trade surplus climbed to €18.5 billion in September from €17.5 billion in August, exceeding expectations for a rise to €18.3 billion.

German adjusted industrial production rose 1.4% in September, missing expectations for a 2.1% gain, after a 3.1% drop in August. August's figure was revised up from a 4.0% fall.

France's trade deficit narrowed to €4.7 billion in September from €5.0 billion in August, beating expectations for an increase to a deficit of €5.2 billion. August's figure was revised up from a deficit of €5.8 billion

French industrial production was flat in September, beating expectations for a 0.1% decline, after a 0.2% fall in August.

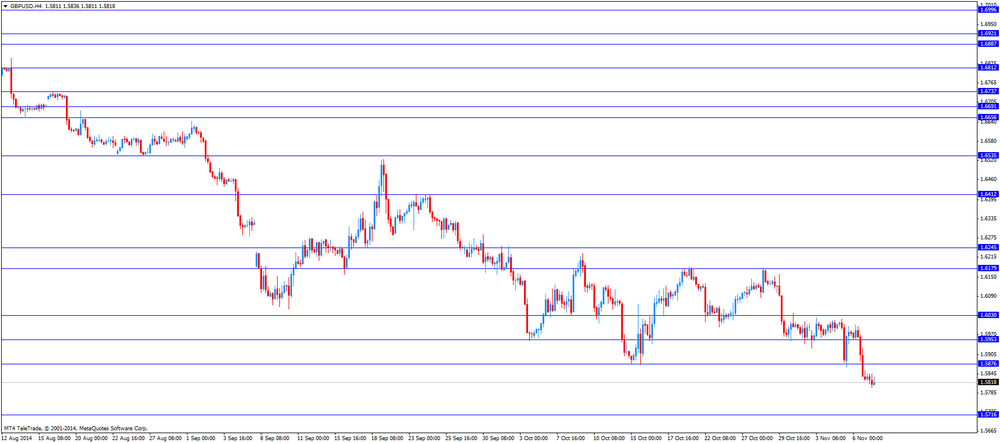

The British pound traded mixed against the U.S. dollar after the trade data from the U.K. The U.K. trade deficit rose to £9.8 billion in September from £8.95 billion in August, missing expectations for a deficit of £9.4 billion. August's figure was revised from a deficit of £9.10 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.8% in October.

Canada's economy is expected to add 400 jobs in October.

The Swiss franc traded higher against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 0.3% in September, missing expectations for a 2.2% rise, after a 1.4% gain in August. August's figure was revised down from a 1.9% increase.

Switzerland's unemployment rate remained unchanged at 3.2% in October.

The Swiss National Bank's foreign exchange reserves declined to 460.427 billion Swiss francs in October from 462.117 billion francs in September. September's figure was revised from 462.194 billion Swiss francs.

EUR/USD: the currency pair rose to $1.2407

GBP/USD: the currency pair traded mixed

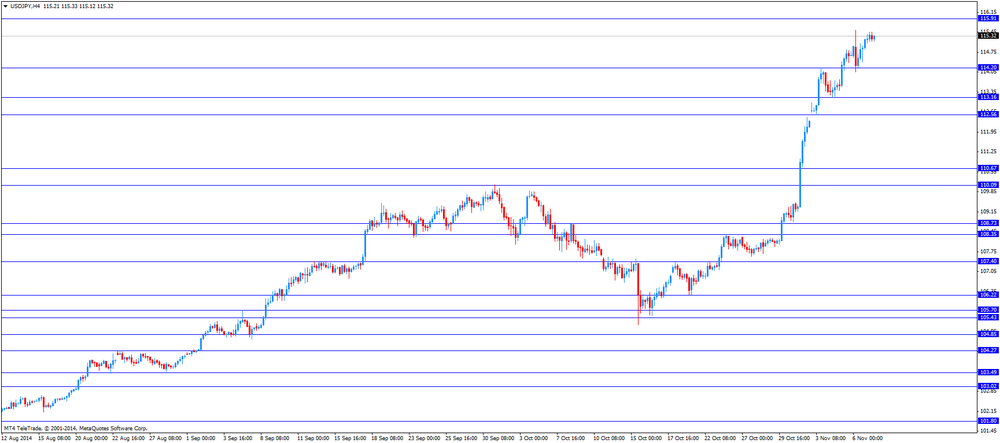

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Employment October 74.1 0.4

13:30 Canada Unemployment rate October 6.8% 6.8%

13:30 U.S. Average hourly earnings October 0.0% +0.2%

13:30 U.S. Nonfarm Payrolls October 248 229

13:30 U.S. Unemployment Rate October 5.9% 5.9%