- Foreign exchange market. Asian session: The greenback lost against its major peers after Fridays U.S. job data fell short of expectations

Notícias do Mercado

Foreign exchange market. Asian session: The greenback lost against its major peers after Fridays U.S. job data fell short of expectations

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans September -0.9% -0.3% -0.7%

01:30 China PPI y/y October -1.8% -1.9% -2.2%

01:30 China CPI y/y October +1.6% +1.6% +1.6%

The greenback traded weaker against its major peers for the second day in a row after U.S. job data (nonfarm payrolls 214,000; forecast 231,000) fell short of expectations although overall unemployment rate dropped from 5.9% to 5.8%, a new six-year low. Investors might be taking profits after the strong rally and reduce their bets on the FED rising interest rates earlier than expected.

The Australian dollar further recovered from his four-year low from last Friday when Australian central bank forecasts showed weak domestic growth. Gains were supported by data published that Chinas export growth did not slow down as much as predicted and China's annual consumer inflation staying near five-year lows.

Those figures also helped the kiwi recovering from its two-year low. Investors are awaiting Reserve Bank governor Wheeler releasing the bank's half-yearly financial stability report on Wednesday and his statements over the strength of the currency.

The Japanese yen currently trading at USD114.16 further recovered from its new record-low of USD115.51 after the BoJ's economic stimulus from last week and a four month rally of the U.S. dollar.

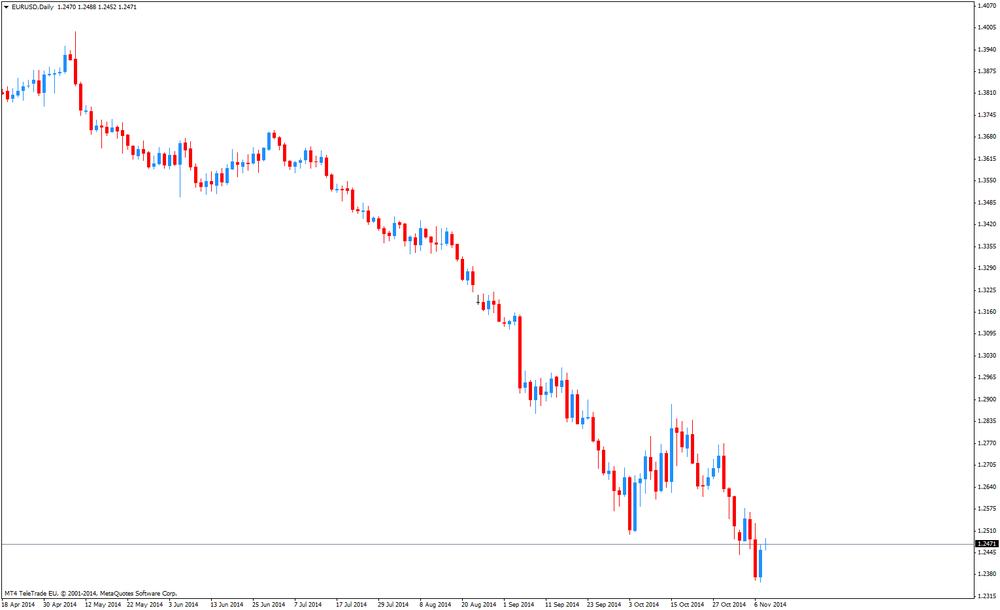

EUR/USD: the currency pair raised to USD1.2471

USD/JPY: the U.S. dollar lost against the Japanese yen and is currently trading at Y114.17

GPB/USD: the currency pair rose to GPB 1.5900

The most important news that are expected (GMT0):

09:30 Eurozone Sentix Investor Confidence November -13.7 -6.9

13:15 Canada Housing Starts October 197 200

23:50 Japan Current Account (adjusted), bln September 130.8 3.0