- Foreign exchange market. European session: the British pound declined against the U.S. dollar after the Bank of England’s inflation letter

Notícias do Mercado

Foreign exchange market. European session: the British pound declined against the U.S. dollar after the Bank of England’s inflation letter

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Wage Price Index, q/q Quarter III +0.6% +0.6% +0.6%

00:30 Australia Wage Price Index, y/y Quarter III +2.6% +2.6% +2.6%

08:00 U.S. FOMC Member Charles Plosser Speaks

09:30 United Kingdom Average Earnings, 3m/y September +0.7% +0.8% +1.0%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September +0.9% +1.1% +1.3%

09:30 United Kingdom Claimant count October -18.6 -24.9 -20.4

09:30 United Kingdom Claimant Count Rate October 2.8% 2.8%

09:30 United Kingdom ILO Unemployment Rate September 6.0% 5.9% 6.0%

10:00 Eurozone Industrial production, (MoM) September -1.4% Revised From -1.8% +0.6% +0.6%

10:00 Eurozone Industrial Production (YoY) September -0.5% Revised From -1.9% -0.4% +0.6%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies. There will be released no major economic reports in the U.S.

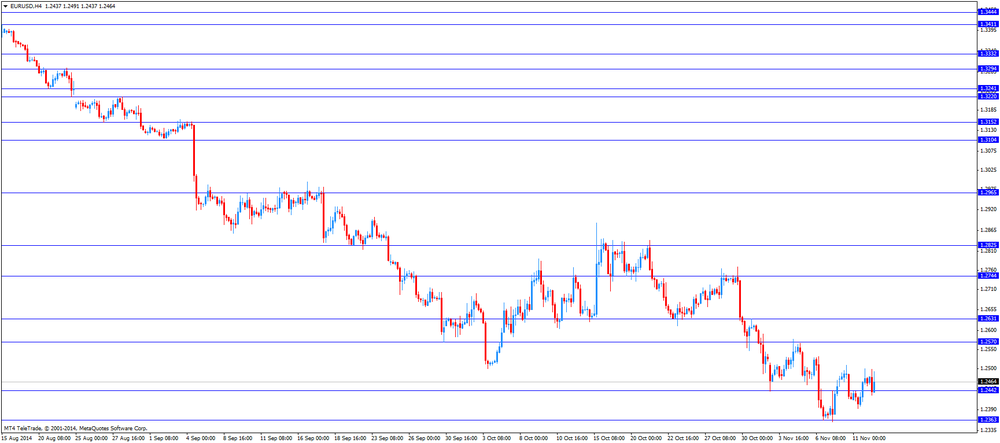

The euro traded slightly lower against the U.S. dollar after industrial production from the Eurozone. Industrial production in the Eurozone rose 0.6% in September, in line with expectations, after a 1.4% drop in August. August's figure was revised up from a 1.8 fall.

On a yearly basis, Eurozone's industrial production increased 0.6% in September, beating expectations for a 0.4% decline, after 0.5% fall in August. August's figure was revised up from a 1.9 drop.

The British pound declined against the U.S. dollar after the Bank of England's inflation letter. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The U.K. unemployment rate remained unchanged at 6.0% in the July to September quarter, missing expectations for a decline to 5.9%.

The claimant count decreased by 20,400 people in October, missing expectations for a drop of 24,900 people, after a decrease of 18,600 people in September.

Average weekly earnings, excluding bonuses, climbed by 1.3% in the July to September period. That was the first time in five years that earnings overtook inflation. Inflation in the U.K. declined to 1.2% in September.

Average weekly earnings, including bonuses, rose by 1.0% in the July to September period.

EUR/USD: the currency pair fell to $1.2429

GBP/USD: the currency pair dropped to $1.5810

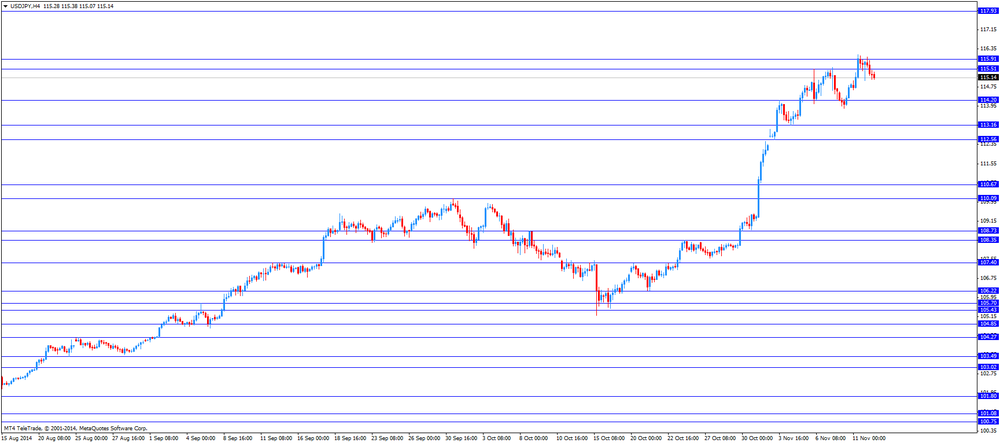

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

15:00 U.S. Wholesale Inventories September +0.7% +0.3%

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

17:00 U.S. FOMC Member Narayana Kocherlakota

21:30 New Zealand Business NZ PMI October 58.1

23:50 Japan Core Machinery Orders October +4.7% -1.0%

23:50 Japan Core Machinery Orders, y/y October -3.3% -1.3%