- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the consumer price indices from Germany and France

Notícias do Mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the consumer price indices from Germany and France

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October +3.4% +4.1%

00:01 United Kingdom RICS House Price Balance October 30% 25% 20%

01:30 Australia RBA Assist Gov Kent Speaks

04:30 Japan Industrial Production (MoM) (Finally) September +2.7% +2.7% +2.9%

04:30 Japan Industrial Production (YoY) September +0.6% +0.6% +0.8%

05:30 China Retail Sales y/y October +11.6% +11.6% +11.5%

05:30 China Industrial Production y/y October +8.0% +8.0% +7.7%

05:30 China Fixed Asset Investment October +16.1% +16.0% +15.9%

07:00 Germany CPI, m/m (Finally) October -0.3% -0.3% -0.3%

07:00 Germany CPI, y/y (Finally) October +0.8% +0.8% +0.7%

07:45 France CPI, y/y October +0.3% +0.5%

07:45 France CPI, m/m October -0.4% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, m/m October -0.1% -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, y/y October -1.4% -1.4% -1.1%

09:00 Eurozone ECB Monthly Report

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to climb by 4,000 to 282,000.

The euro traded higher against the U.S. dollar after the consumer price indices from Germany and France. Germany's final consumer price index declined 0.3% in October.

On a yearly basis, German final consumer price index rose 0.7% in October, lower than the previous reading of 0.8% gain.

France's consumer price inflation was flat in October, beating expectations for a 0.1% decline, after a 0.4% drop in September.

On a yearly basis, French consumer price index increased 0.5% in October, after a 0.3% rise in September.

The British pound fell against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England's inflation letter released on Wednesday still weighed on the pound. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The Canadian dollar traded mixed against the U.S. dollar ahead Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in September, after a 0.3% gain in August.

The Swiss franc traded higher against the U.S. dollar. Switzerland's producer and import prices declined 0.1% in October, beating forecasts of a 0.2% decrease, after a 0.1% fall in September.

On a yearly basis, producer and import prices decreased 1.1% in October, beating expectations for a 1.4% decline, after a 1.4% drop in September.

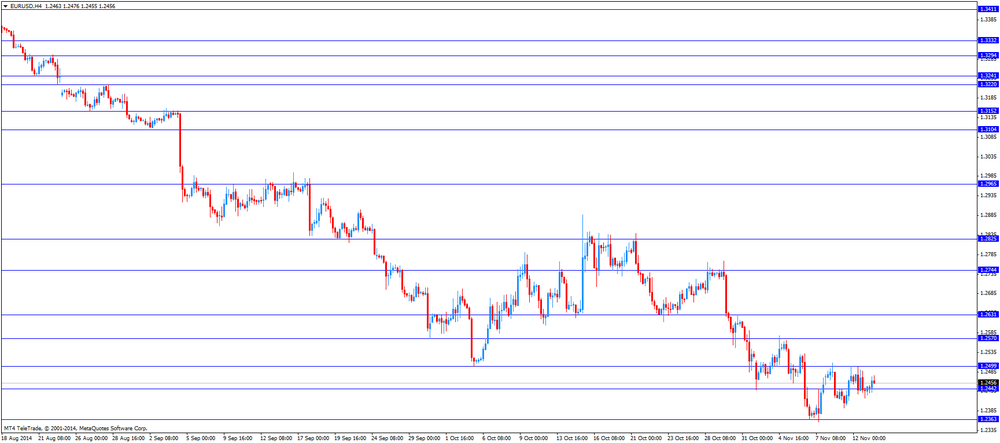

EUR/USD: the currency pair rose to $1.2476

GBP/USD: the currency pair fell to $1.5738

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index September +0.3% +0.2%

13:30 U.S. Initial Jobless Claims November 278 282

15:00 U.S. JOLTs Job Openings September 4835 4850

20:05 Canada Gov Council Member Wilkins Speaks