- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone

Notícias do Mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Meeting's Minutes

08:25 Australia RBA's Governor Glenn Stevens Speech

09:30 United Kingdom Retail Price Index, m/m October +0.2% +0.1% 0.0%

09:30 United Kingdom Retail prices, Y/Y October +2.3% +2.3% +2.3%

09:30 United Kingdom RPI-X, Y/Y October +2.3% +2.4%

09:30 United Kingdom Producer Price Index - Input (MoM) October -0.6% -1.4% -1.5%

09:30 United Kingdom Producer Price Index - Input (YoY) October -7.4% -8.3% -8.4%

09:30 United Kingdom Producer Price Index - Output (MoM) October -0.1% -0.2% -0.3%

09:30 United Kingdom Producer Price Index - Output (YoY) October -0.4% -0.2% -0.5%

09:30 United Kingdom HICP, m/m October 0.0% +0.1% +0.1%

09:30 United Kingdom HICP, Y/Y October +1.2% +1.2% +1.3%

09:30 United Kingdom HICP ex EFAT, Y/Y October +1.5% +1.6% +1.5%

10:00 Eurozone ZEW Economic Sentiment November 4.1 4.3 11

10:00 Germany ZEW Survey - Economic Sentiment November -3.6 0.9 11.5

The U.S. dollar mixed to lower against the most major currencies ahead of the U.S. producer price index and the NAHB housing market index. The U.S. PPI is expected to decline 0.1% in October, after a 0.1% fall in September.

The NAHB housing market index is expected to climb to 55 in November from 54 in October.

The euro traded higher against the U.S. dollar after the better-than-expected ZEW economic sentiment index from the Eurozone. Germany's ZEW economic sentiment index increased 15.1 in November from -3.6 in October, exceeding expectations for a rise to 0.9.

Eurozone's ZEW economic sentiment index climbed to 11.0 in October from 4.1 in September, beating expectations for a gain to 4.3.

The British pound traded mixed against the U.S. dollar after the mixed economic data from the U.K. The U.K. consumer price index rose to an annual rate of 1.3% in October from 1.2% in September. Analysts had expected the consumer price inflation to remain unchanged at 1.2%.

Consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at 1.5% in October, missing expectations for an increase to 1.6%.

The Bank of England's inflation target is about 2%.

EUR/USD: the currency pair rose to $1.2539

GBP/USD: the currency pair traded mixed

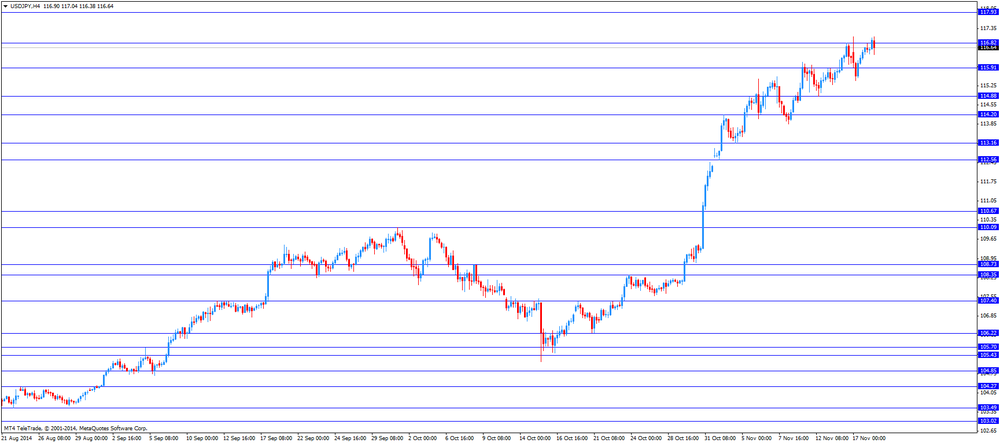

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. PPI, m/m October -0.1% -0.1%

13:30 U.S. PPI, y/y October +1.6% +1.3%

13:30 U.S. PPI excluding food and energy, m/m October 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October +1.6% +1.5%

15:00 U.S. NAHB Housing Market Index November 54 55

18:30 U.S. FOMC Member Narayana Kocherlakota

21:00 U.S. Net Long-term TIC Flows September 52.1 41.3

21:00 U.S. Total Net TIC Flows November 74.5