- Oil fell

Notícias do Mercado

Oil fell

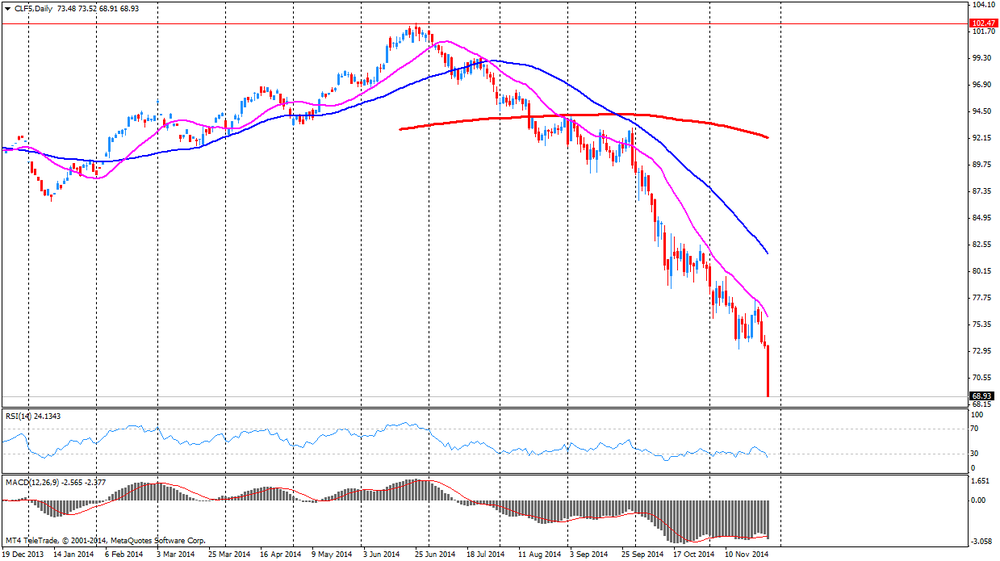

Brent fell below $75 a barrel for the first time since September 2010 after OPEC refrained from cutting production limits at its meeting in Vienna. West Texas Intermediate also slid.

Futures tumbled as much as 4.4 percent in London and 3.9 percent in New York after Saudi Oil Minister Ali Al-Naimi said the group maintained its collective ceiling of 30 million barrels a day.

Crude collapsed into a bear market last month amid the highest U.S. output in three decades and signs of slowing global demand growth. A total of 58 percent of respondents in a Bloomberg Intelligence survey this week had forecast no change to the target.

The decision is "going to end in great consternation for the cartel because these prices are going to continue to tumble," John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone. "They have chosen to toughen out and challenge the higher-cost producers."

Brent for January settlement declined as much as $3.39 to $74.36 a barrel on the London-based ICE Futures Europe exchange, the lowest since Aug. 31, 2010. It was at $74.71 at 10:25 a.m. New York time.