- Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greek exit from the Eurozone weighed on the euro

Notícias do Mercado

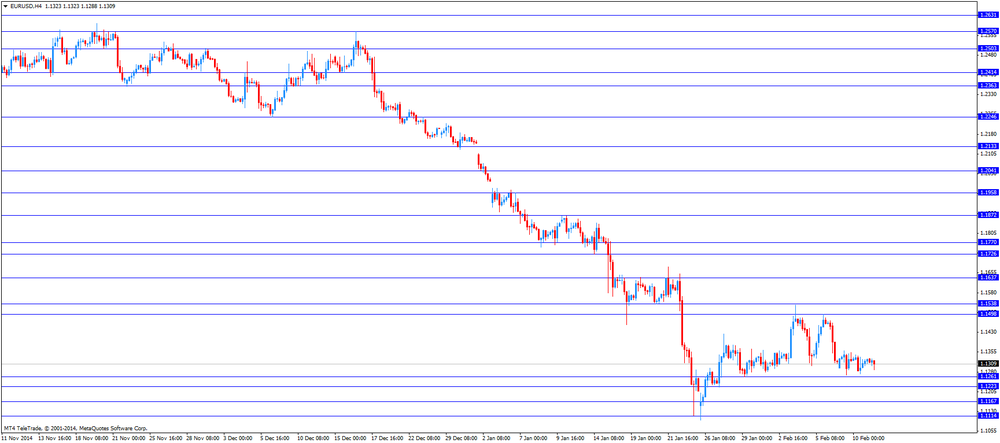

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greek exit from the Eurozone weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia Home Loans December -0.4% Revised From -0.7% +2.3% +2.7%

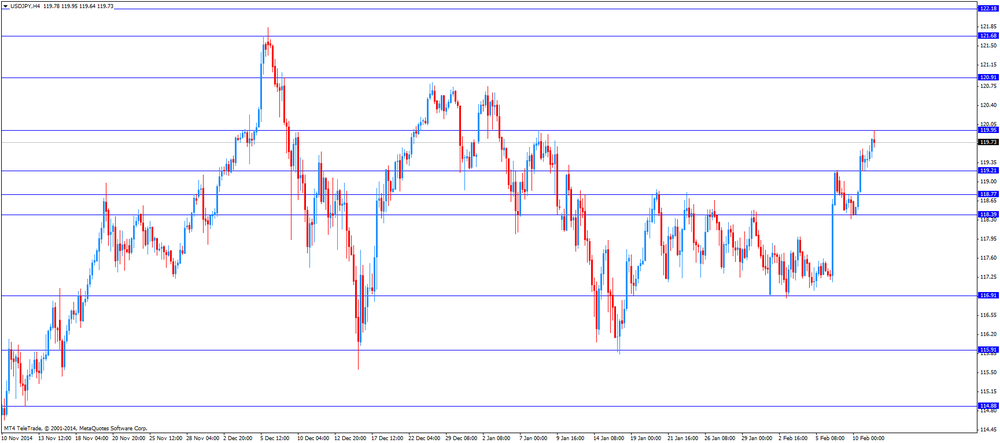

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded lower against the U.S. dollar as concerns over Greek exit from the Eurozone weighed on the euro. The euro group of finance ministers will meet in Brussels later in the day. Greece's Finance Minister Yanis Varoufakis is expected to present new reform proposals.

Investors speculate that the European Commission could extend Greece's existing bailout program. But German Finance Minister Wolfgang Schaeuble said today that there are no plans for a new agreement.

The British pound rose against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair fell to $1.1288

GBP/USD: the currency pair increased to $1.5298

USD/JPY: the currency pair rose to Y119.95

The most important news that are expected (GMT0):

17:30 Eurozone Eurogroup Meetings

21:30 New Zealand Business NZ PMI January 57.7

22:00 Australia RBA Assist Gov Debelle Speaks

23:50 Japan Core Machinery Orders December +1.3% +2.4%

23:50 Japan Core Machinery Orders, y/y December -14.6% +5.9%