- Wall Street. Major U.S. stock-indexes demonstrated mixed dynamics

Notícias do Mercado

Wall Street. Major U.S. stock-indexes demonstrated mixed dynamics

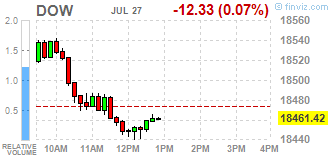

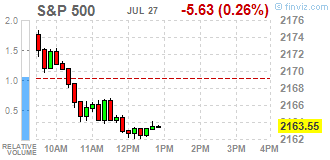

Major U.S. stock-indexes demonstrated mixed dynamics as encouraged by better-than-expected quarterly results of Apple (AAPL) growth in the technology sector was offset by decline in energy sector on weakening oil prices. Investors also expect the US Federal Reserve decision to raise interest rates.

Oil prices dropped sharply after a government report showed that the U.S. crude inventories unexpectedly rose during the week ending July 22.

In macroeconomic environment, the Commerce Department reported orders for the U.S.durable goods fell 4% in June, marking the biggest drop in almost two years. Economists had forecast durable goods orders falling 1.1 percent last month.

The National Association of Realtors (NAR) reported pending home sales in June increased by mere 0.2% to 111.0 points. That was the second highest value in the last 12 months and well above the average reading for 2015 (108.9 points). Economists had expected the index to increase by 1.4% after falling 3.7% in May.

Most of Dow stocks in negative area (22 of 30). Top loser - The Coca-Cola Company (KO, -3.44%). Top gainer - Apple Inc. (AAPL, +6.55%).

All S&P sectors, but for Healthcare (+0.06%), in negative area. Top loser - Utilities (-0.96%).

At the moment:

Dow 18390.00 -8.00 -0.04%

S&P 500 2158.25 -5.00 -0.23%

Nasdaq 100 4686.75 +23.00 +0.49%

Crude Oil 41.96 -0.96 -2.24%

Gold 1325.90 +5.10 +0.39%

U.S. 10yr 1.55 -0.02