- AUD/NZD Price Analysis: Bulls struggle to catch a breakout

Notícias do Mercado

AUD/NZD Price Analysis: Bulls struggle to catch a breakout

- AUD/NZD remains in consolidation as supply battles with demand.

- AUD/USD bulls appear to be buying into supply which could lead to a breakout.

- The daily M-formation's neckline is compelling as an upside target.

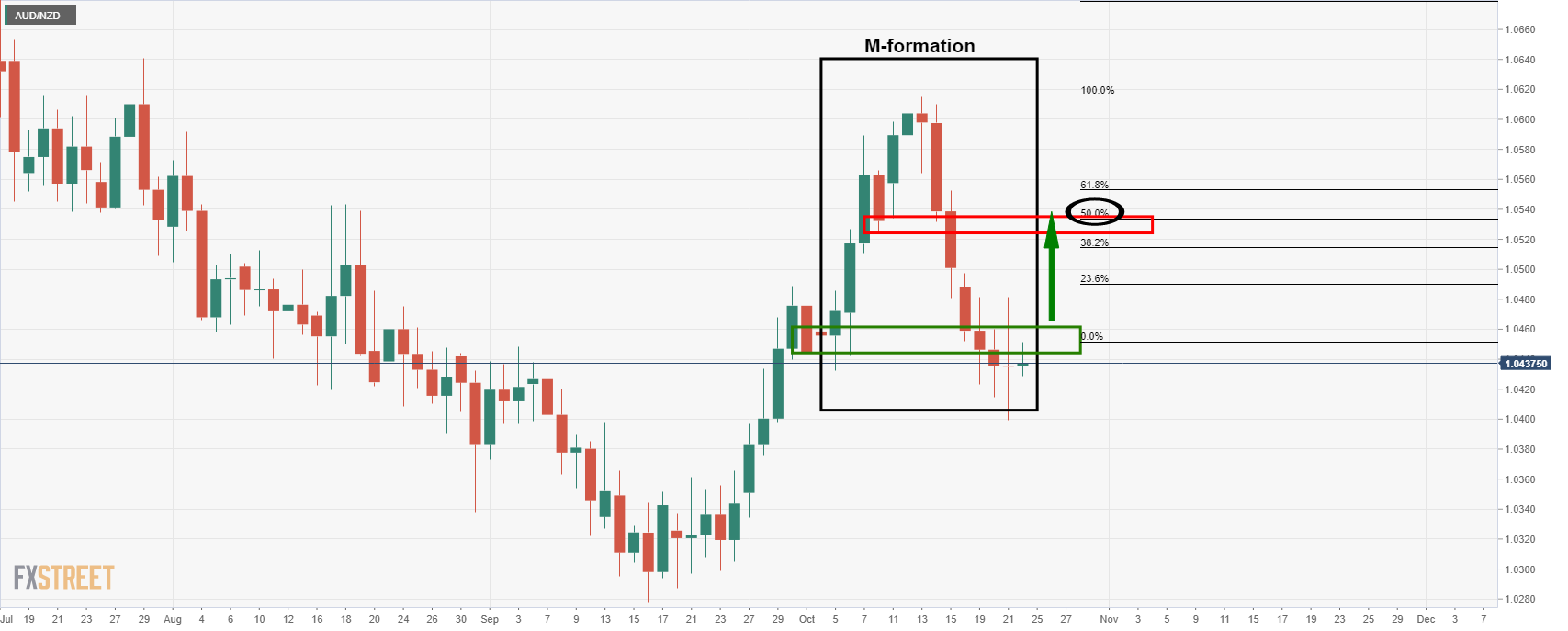

The following is an update of the prior analyst as follows AUD/NZD Price Analysis: Accumulation is occurring, bulls are taking over. The market is moving sideways and a trapped environment between hourly support and resistance but there are prospects of a bullish breakout to test the neckline of the following daily M-formation at 1.0524:

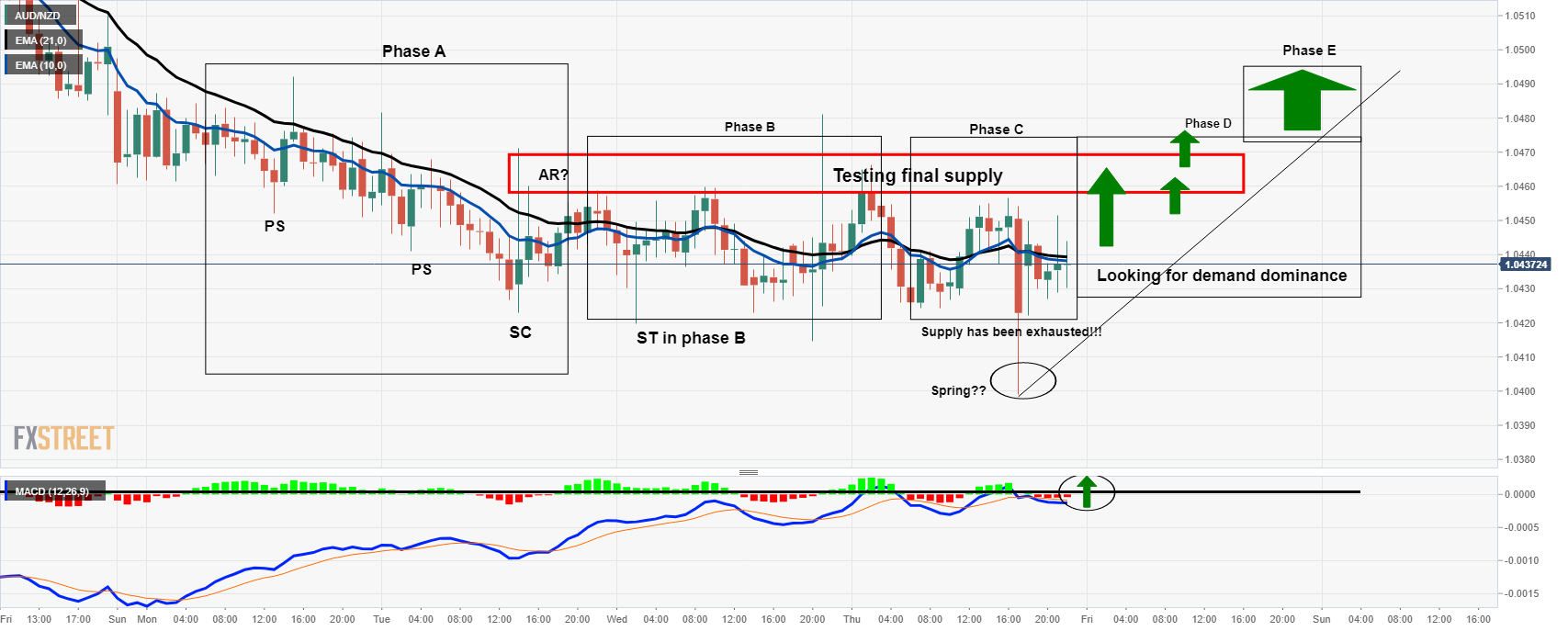

Meanwhile, on the hourly chart, the Wycoff theory is put to test on the following chart which has been updated from this in yesterday's analysis...

...to the following...

In this updated version in today's live market analysis, we can see that the supply was still not exhausted and that the market was not ready to move higher. However, we could now be seeing those final offers being accumulated in what would be expected to result in a move to resistance and demand dominance:

If the spring has been identified correctly this time around, then this is the end of phase C and a breakout is imminent. MACD zero line cross and the 10/21 EMA crossover are useful to determine the bias. While there have been a couple of false signals since yesterday, ideally they should be accompanied by a break of resistance structures within the accumulation. So far, we have not seen this.