- AUD/USD Price Analysis: Bulls testing 0.7500 ahead of CPI

Notícias do Mercado

AUD/USD Price Analysis: Bulls testing 0.7500 ahead of CPI

- AUD/USD is testing the waters in the 0.75 area.

- Weekly resistance is a conundrum for the bulls at this juncture.

AUD/USD is on the verge of a break of 0.75 psychological resistance, but the longer-term time frames are less than favourable given the amount of weekly resistance ahead.

Meanwhile, the event for the day is the Consumer Price Index and the following is the hourly picture leading into the event:

AUD/USD 1-HR chart

The price broke the trendline resistance in 0.7485 during the start of the European session ad has since carved a fresh dynamic resistance near 0.75 the figure. A break of that will open risk towards 0.7505. On the downside, and should the data disappoint, the bears will be seeking a break below 0.7480 for a run towards 0.7440.

Meanwhile, the following is a top-down analysis of the weekly and daily charts that illustrate the predicament for the bulls.

Daily chart

The daily chart is offering prospects of an upside continuation and while it is probable that the market will indeed continue higher, the weekly resistance must be noted.

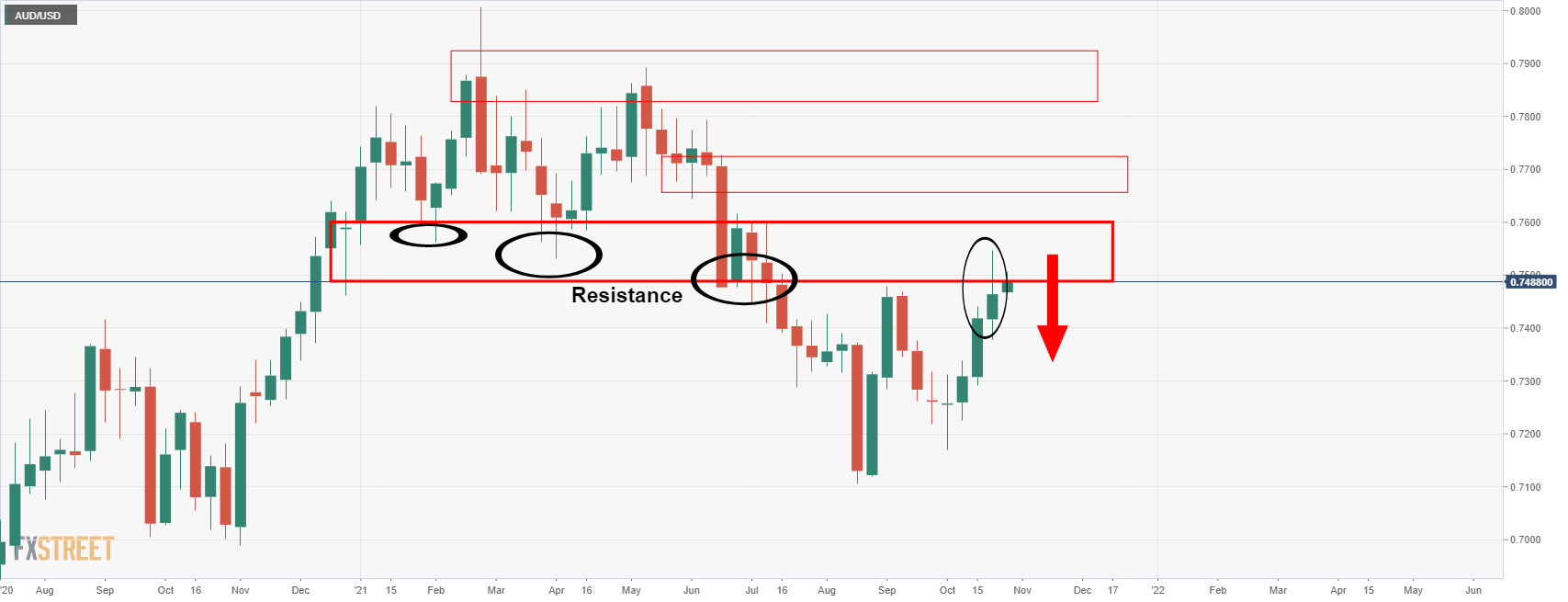

Weekly chart

As illustrated on the weekly chart above for AUD/USD, the price is testing a wall of resistance. There is room to move a touch higher but last weeks' candle was lacking bullish momentum which leaves a bearish bias while below 0.7550.