- Crude Oil Futures: A sustainable retracement appears unlikely

Notícias do Mercado

Crude Oil Futures: A sustainable retracement appears unlikely

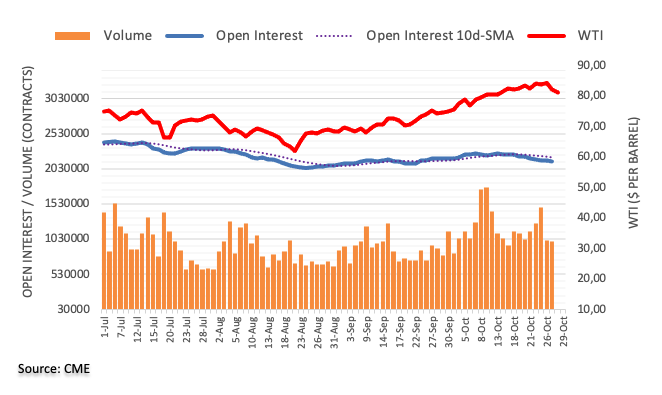

CME Group’s advanced figures for crude oil futures markets noted investors trimmed their open interest positions for the fifth consecutive session on Tuesday, this time by around 5.7K contracts. In the same line, volume dropped by more than 15K contracts, recording the second pullback in a row.

WTI now looks to $80.00

Wednesday’s selloff in prices of the WTI came in tandem with shrinking open interest and volume. Despite a technical correction was overdue in light of the overbought conditions of the commodity, a convincing and sustainable drop seems to be out of favour at least in the very near term. In the meantime, the $80.00 mark per barrel emerges as the next magnet for sellers for the time being.