- EUR/GBP Price Analysis: Trapped market, but opportunities are ripening

Notícias do Mercado

EUR/GBP Price Analysis: Trapped market, but opportunities are ripening

- EUR/GBP is trapped from a 4-hour perspective.

- Bulls are on the lookout for a break of current weekly resistance for a deeper correction.

- Scalpers are monitoring the faster price action and near-term support for a possible 50% mean reversion opportunity.

The price of the cross has been correcting the weekly bearish impulse and traders are awaiting the next moves in the pair for an optimal entry. The following illustrates the weekly, 4-hour and 1-hour markets structure and potential trading opportunities on the horizon.

EUR/GBP weekly chart

The price of EUR/GBP has seen a strong correction as per the weekly chart and the neckline of the M-formation is compelling given the confluence with the 38.2% Fibonacci retracement level near to 0.85 the figure. However, the price still needs to surpass the current resistance as illustrated below:

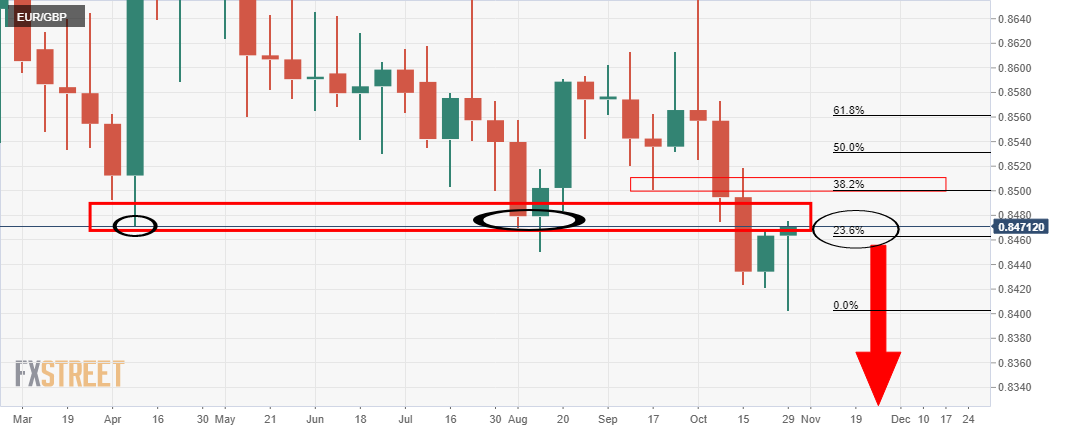

The price is meeting the 23.6% Fibo that has a confluence with the prior summer and April lows near 0.8472.

Meanwhile, from a 4-hour perspective the market is trapped between support and resistance as follows:

EUR/GBP 4HR chart

Until the price can break either above 0.8490 or below 0.8420, there is little bias one way or the other and scalping on the lower timeframes are where the opportunities stay for now.

EUR/GBP 1HR chart

The 50% mean reversion target aligns well with the structure looking left from the current price. bears will likely look to engage once the current support is broken, looking for bearish structure and favourable momentum.