- AUD/USD Price Analysis: Stays on the way to 0.7070 hurdle

Notícias do Mercado

AUD/USD Price Analysis: Stays on the way to 0.7070 hurdle

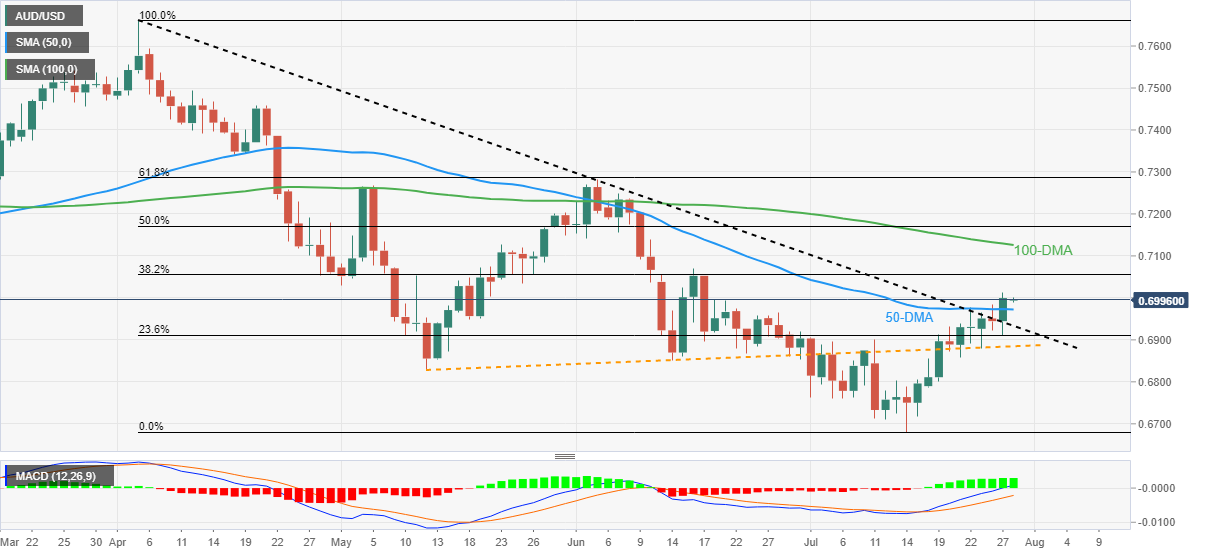

- AUD/USD remains sidelined after refreshing multi-day high, crossing the key hurdles.

- Bullish MACD signals back the technical breakouts to direct buyers towards mid-June high.

- 50-DMA restricts immediate downside, 100-DMA challenges buyers past 0.7070.

AUD/USD buyers flirt with the 0.7000 threshold, after refreshing the six-week high the previous day, as traders await Australia’s Q2 Import Price Index and Retail Sales for June during Thursday’s Asian session.

Even so, a successful upside break of the previous resistance line from April and the 50-DMA, as well as the bullish MACD signals, hint at the AUD/USD pair’s further upside.

That said, the 38.2% Fibonacci retracement of the April-July downside, also nearing the mid-June swing high around 0.7070, appears to be the immediate resistance for the pair.

Following that, the 100-DMA level near 0.7125 could challenge the AUD/USD bulls/

Alternatively, pullback moves may initially aim for the 50-DMA level of 0.6972 before testing the previous resistance line near 0.6930.

However, the AUD/USD bears remain cautious until the quote stays beyond an upward sloping support line from May 12, close to 0.6885 by the press time.

Overall, AUD/USD remains on the bull’s radar ahead of the key Aussie data.

AUD/USD: Daily chart

Trend: Further upside expected