- Crude Oil Futures: Corrective downside in the pipeline?

Notícias do Mercado

Crude Oil Futures: Corrective downside in the pipeline?

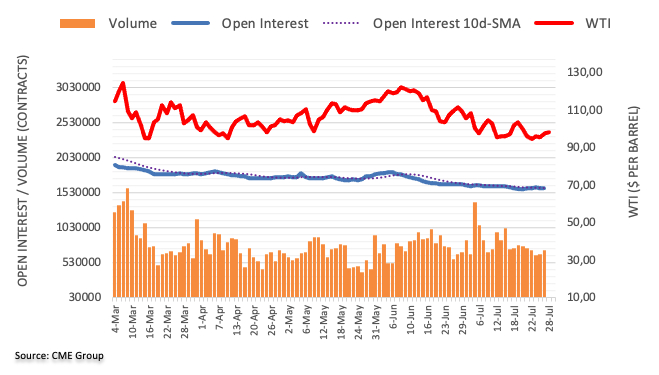

Considering advanced prints from CME Group for crude oil futures markets, traders trimmed their open interest positions by nearly 5K contracts on Wednesday, reaching the second daily drop in a row. Volume, on the other hand, rose for the second consecutive session, now by more than 61K contracts.

WTI looks capped by $100.00

WTI prices charted decent gains on Wednesday. The uptick, however, faltered ahead of the key $100.00 mark and was accompanied by shrinking open interest, hinting at the idea that a potential corrective move could be shaping up in the near term. That said, a convincing breach of the 200-day SMA at $94.95 could spark a deeper decline to the July low at $90.58 (July 14).