- Gold Price Forecast: XAU/USD sees an establishment above $1,760, US PCE buzz

Notícias do Mercado

Gold Price Forecast: XAU/USD sees an establishment above $1,760, US PCE buzz

- Gold price is likely to establish above $1,760.00 as DXY sees more downside.

- The optimism in gold price is back by declining Fed’s confidence in US economic data.

- A preliminary estimate for the US PCE is 6.7% vs. 6.3% recorded earlier.

Gold price (XAU/USD) is likely to hit the immediate hurdle of $1,760.00, tracking the current upside momentum. The precious metal extended its gains swiftly on Thursday after violating the critical barricade of $1,740.00. The release of the downbeat US Gross Domestic Product (GDP) underpinned the gold prices and the asset is expected to establish above the immediate hurdle of $1,760.00 sooner.

The Federal Reserve (Fed) has been elevating its interest rates as solid US fundamentals were providing room to Fed policymakers. Fed’s tedious job of declining demand simultaneously with increasing interest rates and increasing supply to derive optimal prices without triggering the chances of a recession was supported by the upbeat US economic data. Now, less confidence in economic data has brought a sense of optimism in the gold price.

In today’s session, the entire focus will remain on US Personal Consumption Expenditure (PCE) inflation data, which is seen higher at 6.7% vs. 6.3% reported earlier. This will keep the need for more policy tightening measures intact.

Gold technical analysis

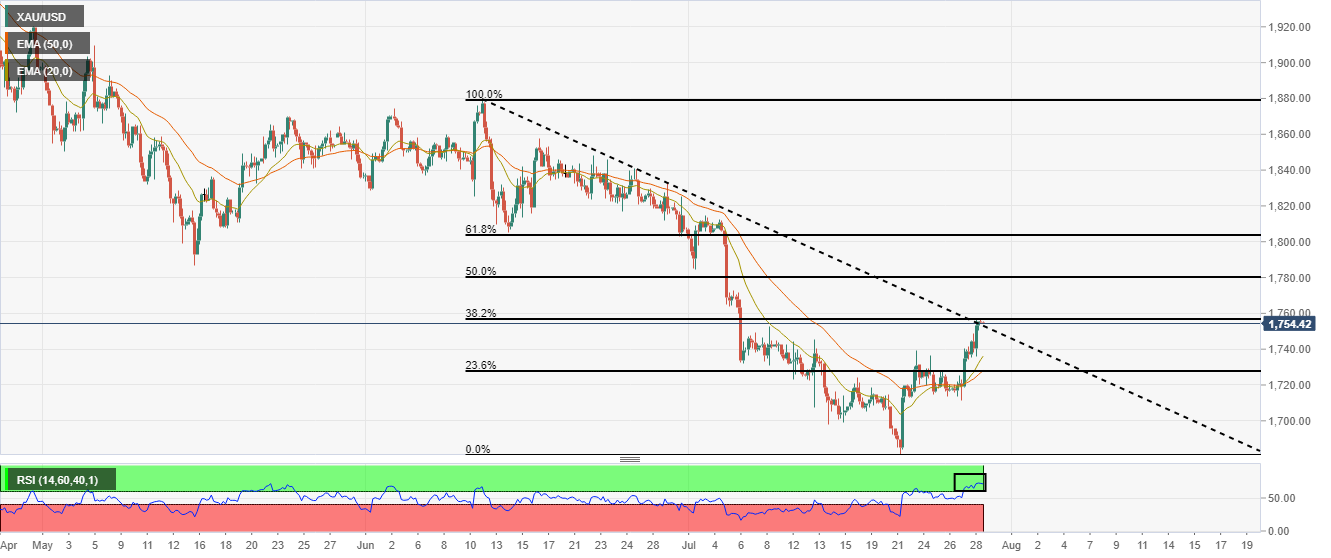

On a four-hour scale, the gold price has attacked the 38.2% Fibonacci retracement (which is placed from June 12 high at $1,879.26 to July 21 low at $1,680.91) at $1,756.64. Also, the precious metal is attempting to establish above the downward-sloping trendline placed from June 12 high at $1,879.26.

A bull cross, represented by the 20- and 50-period Exponential Moving Averages (EMAs) at $1,720.80 adds to the upside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates a continuation of an upside momentum ahead.

Gold four-hour chart