- USD/CHF Price Analysis: 100-DMA probes bulls on the way to 0.9680

Notícias do Mercado

USD/CHF Price Analysis: 100-DMA probes bulls on the way to 0.9680

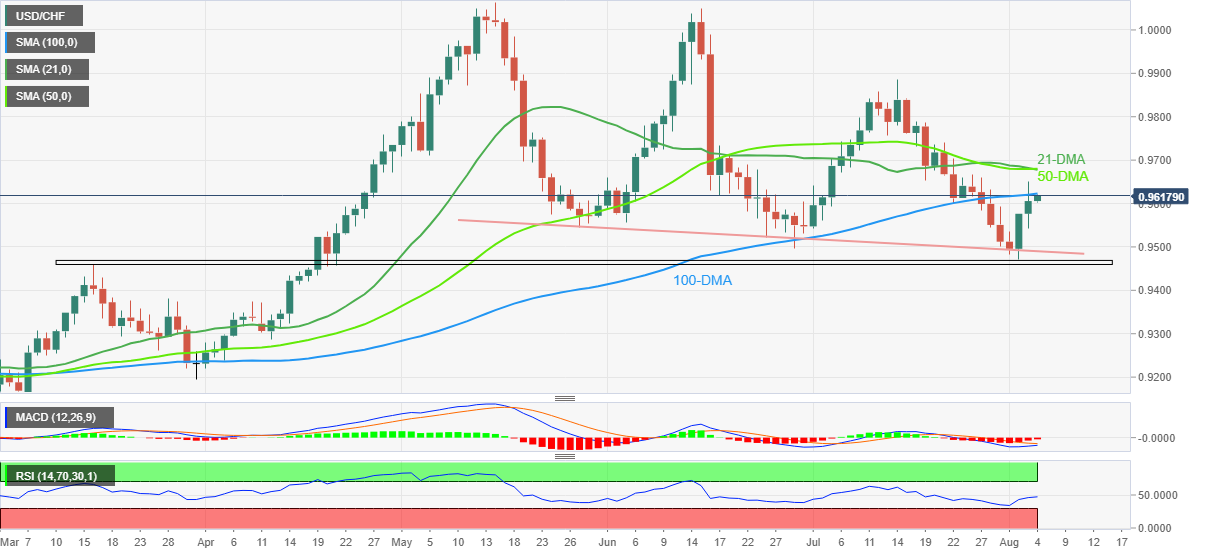

- USD/CHF picks up bids to print three-day uptrend after bouncing off short-term key support.

- Convergence of 21-DMA, 50-DMA appears a tough nut to crack for bulls.

- RSI, MACD hints at further recovery moves, 100-DMA guards immediate upside.

USD/CHF bulls attack the 100-DMA hurdle while picking up bids to 0.9620 during early Thursday morning in Europe. In doing so, the Swiss currency (CHF) pair rises for the third consecutive day after Tuesday’s rebound from the lowest levels since late April.

The recovery moves also took place from a 10-week-old downward sloping trend line. That said, the recently firmer RSI and an impending bull cross on the MACD also keep USD/CHF buyers hopeful.

However, a daily closing beyond the 100-DMA level surrounding 0.9625 becomes necessary for the pair to convince buyers.

Even so, a confluence of the 21-DMA and 50-DMA, around 0.9680, will be a crucial resistance for the USD/CHF bulls to cross before taking control.

Alternatively, the pair’s pullback moves may aim for the 0.9600 and the 0.9500 thresholds before revisiting the downward sloping support line from late May, around 0.9490 by the press time.

Also acting as a downside filter is a horizontal area comprising the latest swing low and March’s peak, around 0.9460-70.

Should the USD/CHF prices drop below 0.9460 support, the odds of witnessing the 0.9400 level back on the chart can’t be ruled out.

USD/CHF: Daily chart

Trend: Further upside expected