- USD/CAD Price Analysis: Bulls and bears battle it out in tight consoldidation

Notícias do Mercado

USD/CAD Price Analysis: Bulls and bears battle it out in tight consoldidation

- USD/CAD is trapped between key hourly support and resistance.

- USD/CAD breakout prospects diminished with US CPI ahead.

As per the start of the week's analysis, USD/CAD Price Analysis: Bears lurking with eyes on a deeper correction, USD/CAD indeed fell into the hands of the bears as the following illustrates:

USD/CAD prior analysis

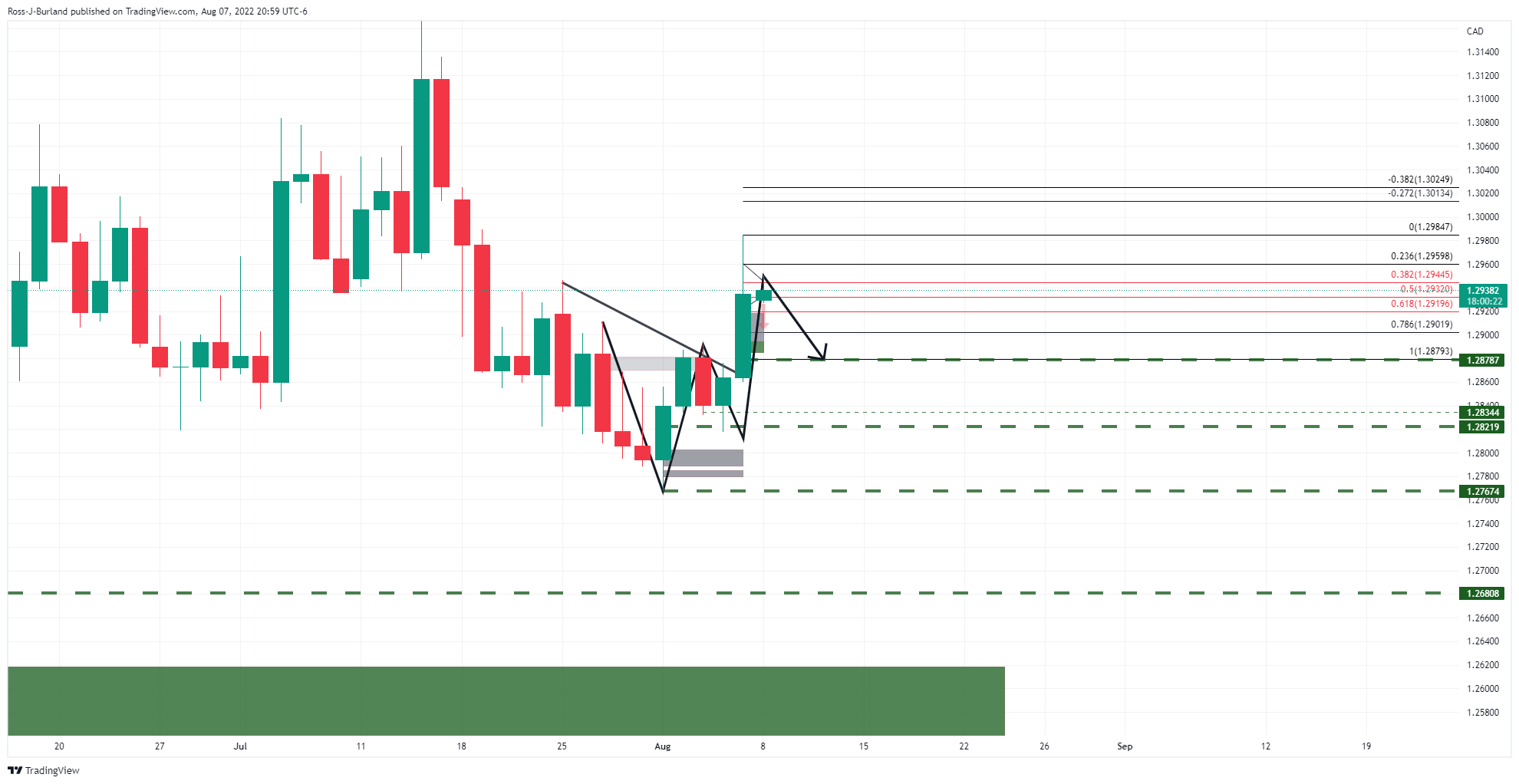

For the hourly time frame, it was explained that ''a break to the downside opens the probability of a move into the area of price imbalance. 1.2880 is a potentially key structure that if broken may give way to a deeper correction towards 1.2820 and 1.2770.''

(USD/CAD H1 chart, above, daily chart below)

It was explained that ''the daily chart's W-formation is a bearish feature with price anticipated to correct the daily bullish impulse towards the neckline. ''

USD/CAD live chart

As illustrated, the price has indeed dropped, respecting the prior analysis of the W-formation and the subsequent pull into the neckline.

As for the 1-hour chart, the price fell out of the coil and besides a brief spell of price discovery in the 1.2880s, the bears stayed in control to test below 1.2850:

The price is coiling again and a break of the corrective highs will likely see the bulls mitigate the price imbalance above. However, resistance could hold and see the price reverse in a continuation of the downside and in an extension of the prior bearish impulse to test towards 1.2820 and potentially beyond with daily structure eyed at 1.2767.

Alternatively, we could simply see the price bounded between 1.2900 and 1.2820 as we head into key US inflation data mid-week: