- Crude Oil Futures: Extra upside not favoured

Notícias do Mercado

9 agosto 2022

Crude Oil Futures: Extra upside not favoured

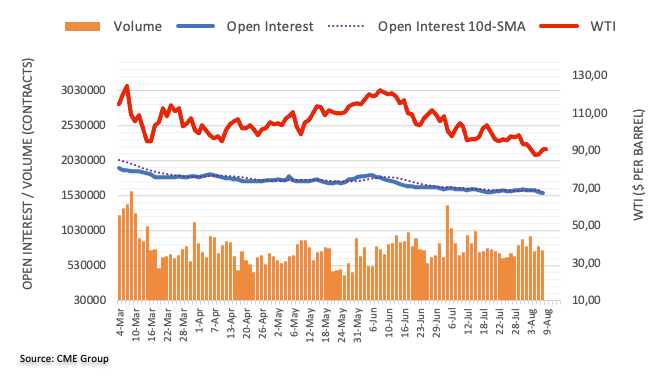

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions by almost 15K contracts at the beginning of the week, reaching the third consecutive daily drop. Volume followed suit and reversed the previous daily build, shrinking by around 61.5K contracts.

WTI: The 200-day SMA caps the upside so far

Monday’s advance to the area above the $90.00 mark was, however, amidst declining open interest and volume, hinting at the idea that the continuation of the uptrend in WTI appears unlikely in the very near term. On this, the 200-day SMA at $95.29 continues to cap occasional bullish attempts for the time being.

O foco de mercado

Abrir Conta Demo e Página Pessoal