- NZD/USD Price Analysis: The barroom brawl scene is coming to a climax

Notícias do Mercado

NZD/USD Price Analysis: The barroom brawl scene is coming to a climax

- NZD/USD bulls need to commit or face being a move into the point of control.

- The daily chart shows prices bounded by channel support and resistance.

NZD/USD is consolidated within a daily range of around 0.6280 with prospects of a move to the ceiling of the channel near 0.6335 but with equal possibilities of a move to the lower boundary near 0.6190. This is known as the barroom brawl where there is little bias one way or the other. With that being said, it could be argued that the bias is to the upside considering the recent break of the trendline resistance. The following illustrates the market structure on both the daily and 4-hour charts.

NZD/USD daily chart

0.6350 is key to the upside while the bears need to get below 0.6190. On a break higher, here is an area of price imbalance that could well be targetted once 0.6550 resistance is overcome. That area is between 0.6645 and 0.6720.

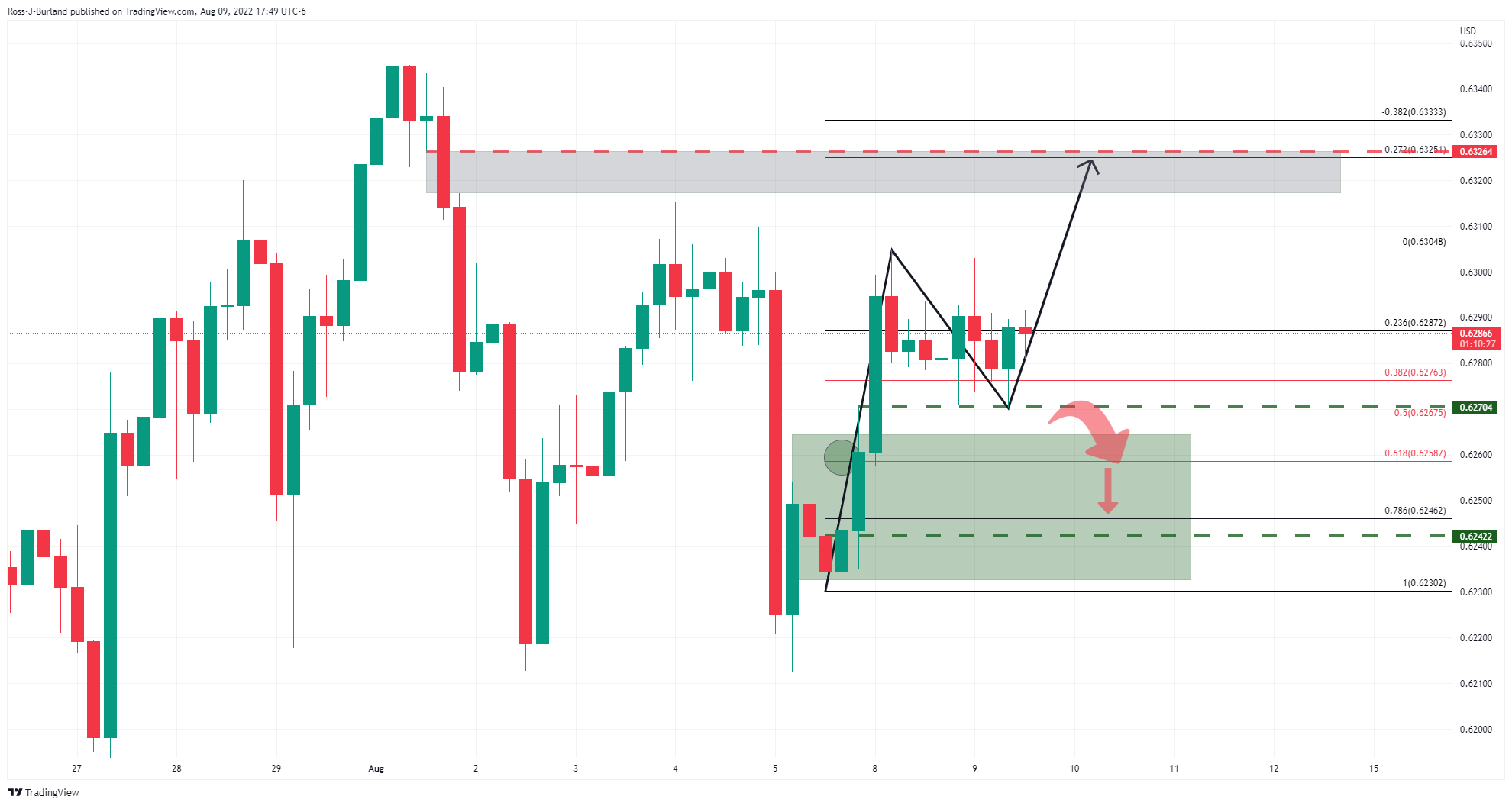

NZD/USD H4 chart

The four-hour chart's outlook is bullish while above the recent lows and would be expected to see the price rally towards the area of imbalance, as per greyed area on the chart above near prior highs of 0.6236. On a break of support, however, the W-formation's neckline and point of control at 0.6742 could be targetted for the sessions ahead.