- Gold Futures: Extra downside not favoured

Notícias do Mercado

16 agosto 2022

Gold Futures: Extra downside not favoured

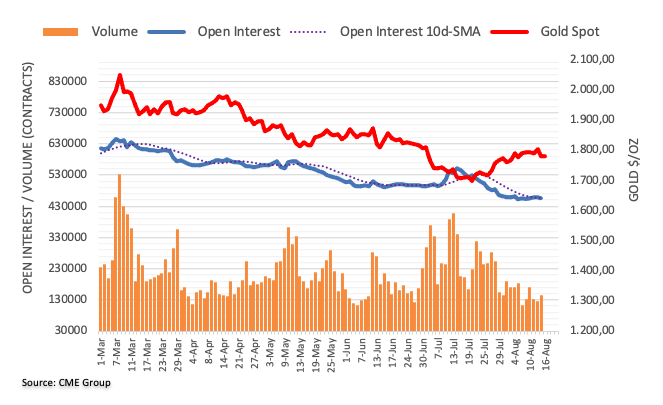

Open interest in gold futures markets reversed three consecutive daily builds and shrank by around 3.5K contracts at the beginning of the week, as per flash data from CME Group. Volume, instead, went up by nearly 18K contracts after two daily drops in a row.

Gold: Rebound now targets $1,800

Gold started the week on the back foot, coming all the way down from the area just above the key $1,800 mark. The noticeable downtick was accompanied by shrinking open interest, which removes strength from further retracements and exposes a probable bounce in the very near term. Against that, the immediate hurdle for the precious metal emerges at the $1,800 mark per ounce troy.

O foco de mercado

Abrir Conta Demo e Página Pessoal