- Crude Oil Futures: Downside looks overdone

Notícias do Mercado

16 agosto 2022

Crude Oil Futures: Downside looks overdone

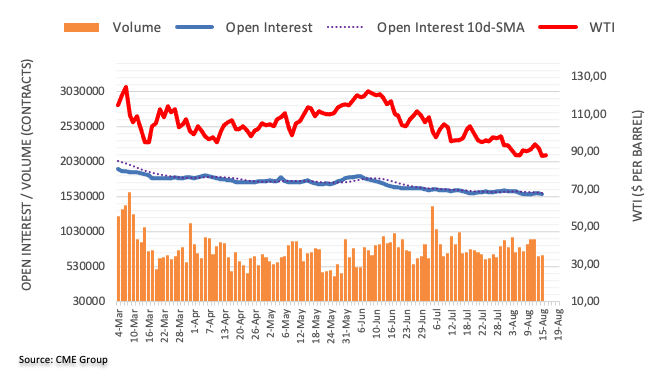

Considering advanced prints from CME Group for crude oil futures markets, traders scaled back their open interest positions by mor than 8K contracts on Monday, following two daily builds in a row. On the other hand, volume partially reversed the previous pullback and went up by around 16.3K contracts.

WTI remains under pressure in the sub-$90.00 area

Prices of the barrel of the WTI extended the leg lower on Monday amidst declining open interest. That said, a deeper pullback appears unlikely in the very near term, while bullish attempts look capped by the 200-day SMA around $95.50 for the time being.

O foco de mercado

Abrir Conta Demo e Página Pessoal