- Crude Oil Futures: Probable respite on the cards

Notícias do Mercado

17 agosto 2022

Crude Oil Futures: Probable respite on the cards

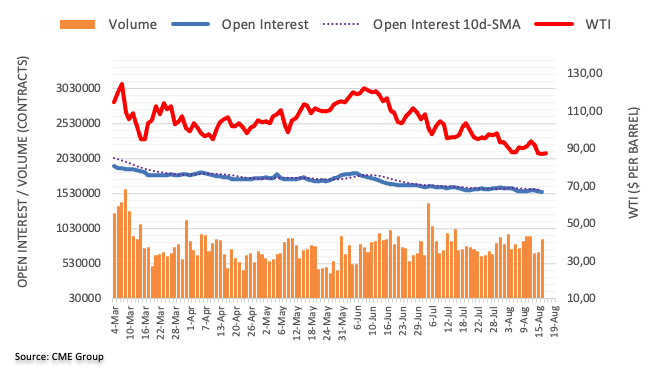

Considering advanced prints from CME Group for crude oil futures markets, traders trimmed their open interest positions by around 6.7K contracts on Tuesday, adding to the previous pullback. Volume, instead, rose for the second straight session, this time by around 183.3K contracts.

WTI stays capped by the 200-day SMA

Prices of the barrel of WTI dropped to new multi-month lows near the $85.00 mark on Tuesday. The continuation of the leg lower was in tandem with shrinking open interest, which could be indicative of a near-term pause in the downside. Against that, the 200-day SMA above the $95.00 mark per barrel continues to limit any occasional bullish attempts in prices.

O foco de mercado

Abrir Conta Demo e Página Pessoal