- USD/TRY leaps to fresh 2022 peaks past 18.00 after CBRT cut rates

Notícias do Mercado

USD/TRY leaps to fresh 2022 peaks past 18.00 after CBRT cut rates

- USD/TRY clinches new YTD tops beyond the 18.00 mark.

- The pair now targets the all-time top at 18.25 (December 20 2021).

- The Turkish central bank reduced the policy rate by 100 bps.

The Turkish lira debilitates to fresh lows vs. the greenback and pushes USD/TRY past the 18.00 yardstick for the first time since December 2021.

USD/TRY now targets the all-time high at 18.25

USD/TRY leaves behind the key barrier at 18.00 after the Turkish central bank (CBRT) caught the markets off guard and reduced the One-Week Repo Rate by a full point to 13.00% at its meeting earlier on Thursday. the central bank also cut the Overnight Borrowing Rate and the Overnight Lending Rate by 100 bps to 11.50% and 14.50%, respectively.

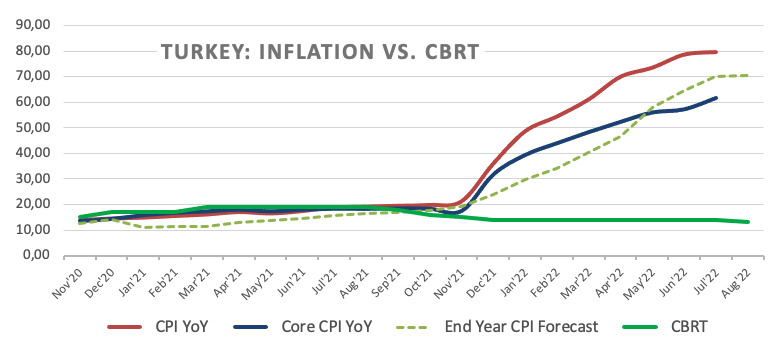

In its statement, the CBRT continues to see domestic inflation largely driven by higher energy costs exclusively on the back of geopolitical events and “effects of pricing formations that are not supported by economic fundamentals”.

Also, according to the bank’s statement, the disinflationary process is expected to start in response to measures taken… which would be…?

In line with previous meetings, the “liraization” strategy remains the way to reach a permanent fall in inflation to the bank’s 5% target, which the CBRT expects to hit at some point in H2 2023. If we consider that inflation ran at nearly 80% YoY in July and that the CBRT forecasts the CPI at 70% by year end, reaching that goal is no less than a chimera in the current context.

It is worth noting that USD/TRY closed with gains in every month of the current year. Since January 2021, the pair recorded monthly losses in only four occasions; January, July, August and December 2021.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and now targets the all-time peak around 18.25 following the recent unexpected move by the CBRT.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.81% at 18.0856 and faces the immediate target at 18.1260 (2022 high August 18) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.4104 (100-day SMA) and finally 16.0365 (monthly low June 27).