- NZD/USD Price Analysis: A fade in the greenback opens risk of significant correction

Notícias do Mercado

NZD/USD Price Analysis: A fade in the greenback opens risk of significant correction

- NZD/USD bears moved in early doors, could be clearing the path for a bullish correction.

- US dollar is stalling on the bid which is bullish for commodity-fx.

NZD/USD bulls could be about to step in following an early Asian slide due to the trade deficit hitting a record high. This has seen the price take on a key support area and prior lows early doors. However, if the equities start off on the right foot in Tokyo on the heels of a positive close on Wall Street, then we could see a move higher in the kiwi. The following illustrates such prospects:

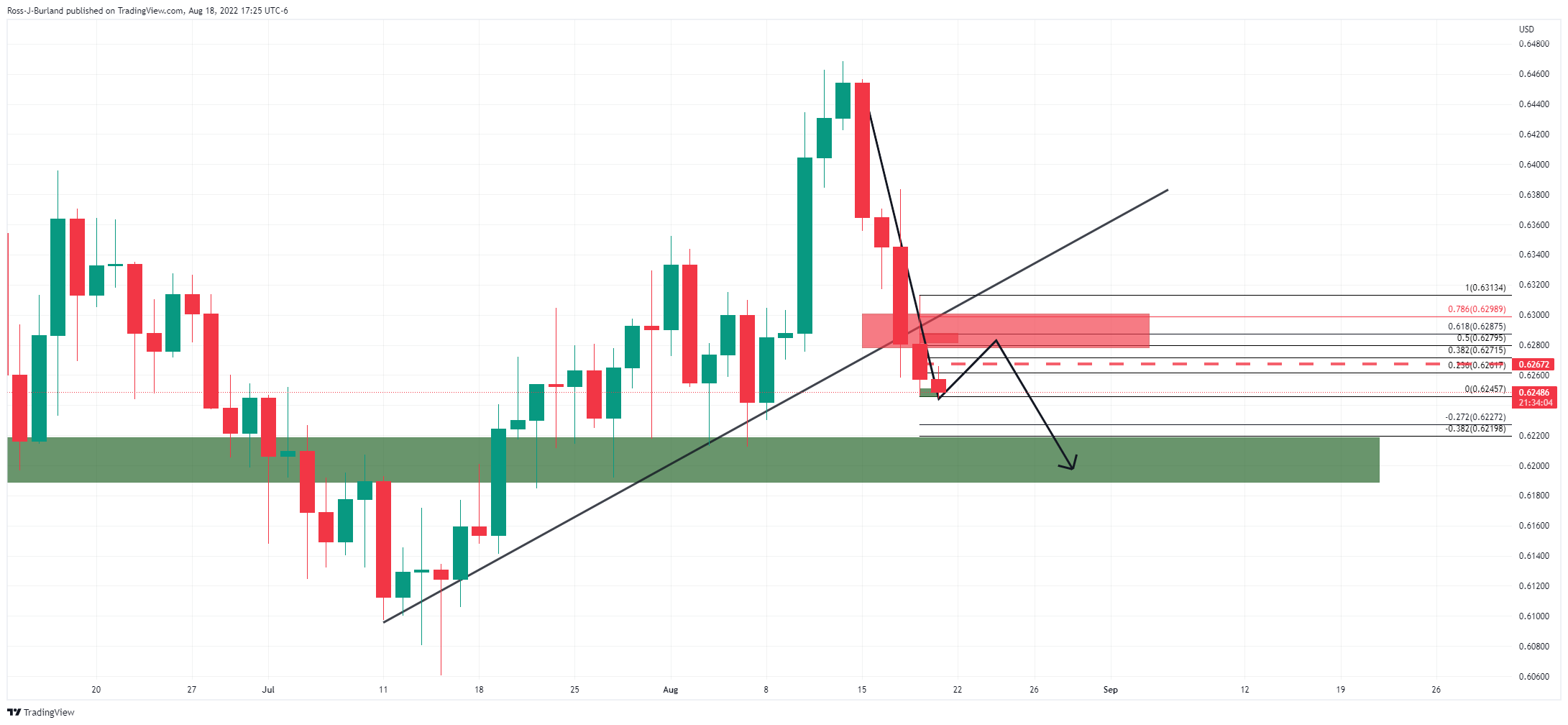

NZD/USD daily chart

The daily chart shows that the price has broken below the trendline and a reversion could be on the cards for the day ahead. The support area, however, could be seen first given the momentum of the price. With that being said, the US dollar could be on the verge of a bearish correction:

DXY H1 chart

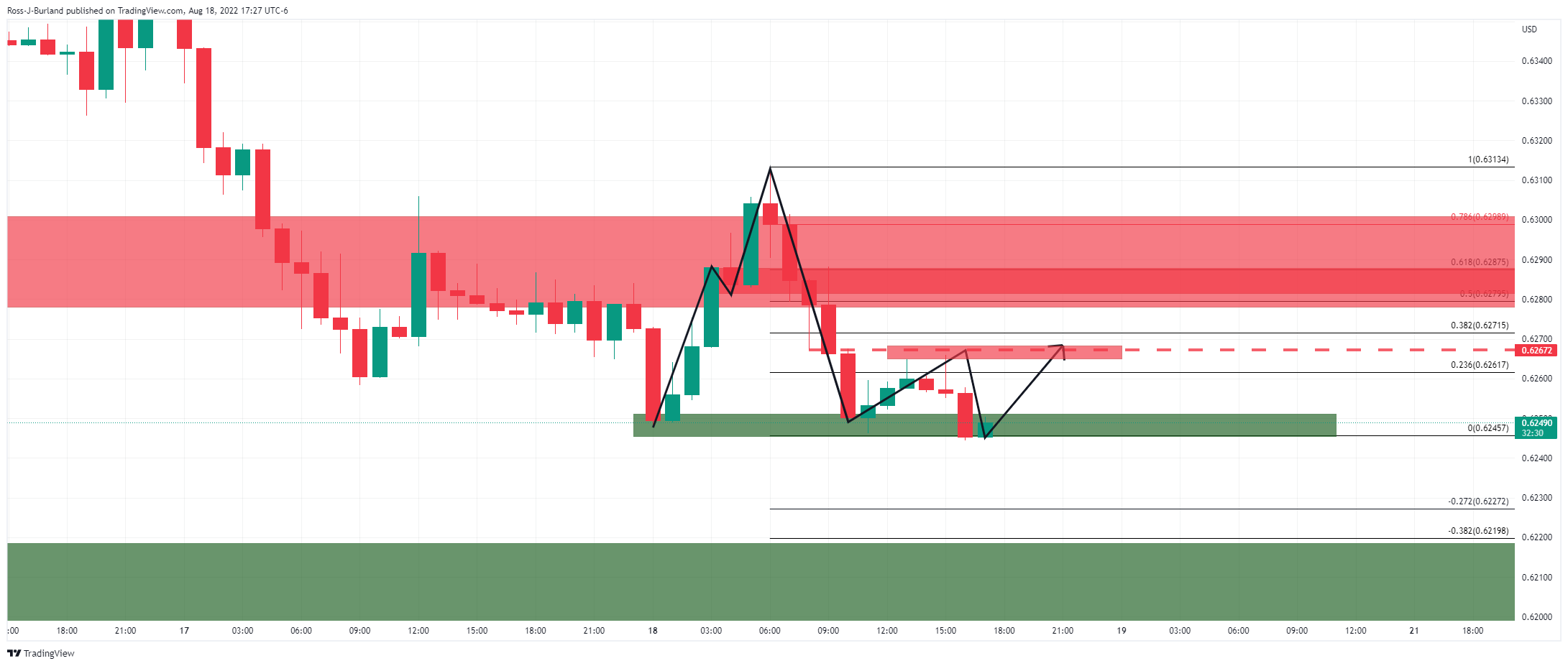

NZD/USD H1 chart

The M-formation is a reversion pattern that could see the price moved in towards the neckline, or at least for a higher correction.

NZD/USD 5-min chart

The price will not likely do anything until Tokyo and given the low volume overnight on Wall Street and the volatility, those trading the kiwi could be in for a bumpy and drawn-out ride. However, The 5-min chart's structures are illustrated above and should the bulls commit, then a correction could play out something along the lines of the above over the course of Friday.