- EUR/USD Price Analysis: Bears taking on critical H4 support

Notícias do Mercado

EUR/USD Price Analysis: Bears taking on critical H4 support

- EUR/USD bulls have moved in and there is a meanwhile focus on a correction.

- The bears, on the other hand, are seeking a break of the critical longer-term support structure.

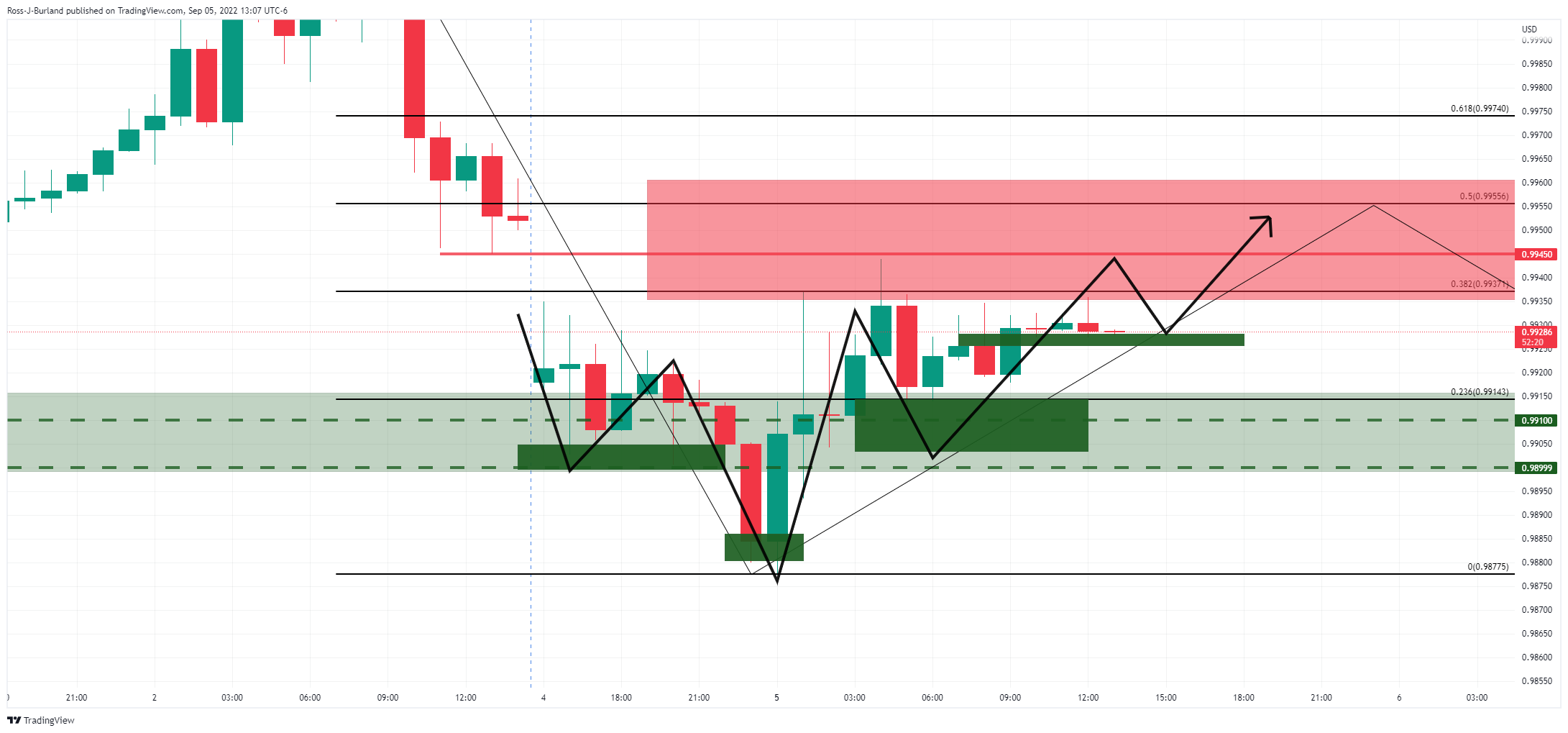

As per the prior analysis from the start of the week, EUR/USD Price Analysis: Bulls eye a 50% mean reversion near 0.9950, the price moved into the key resistance but has subsequently fallen down to test a critical support structure again.

The following illustrates the bearish bias while below 0.9980:

EUR/USD prior analysis

As illustrated above, the price was creeping in on the gap and it had made a 38.2% Fibonacci retracement, but a fuller correction was to be expected prior to the next bearish impulse to the downside.

The bullish inverse head and shoulders were also a compelling feature on the hourly time frame:

EUR/USD live update

As shown, the price followed the projections accordingly and now the focus is on the M-formation and critical support that could now act as resistance:

On the other hand, there are bullish structures that have formed on the lower timeframes. The following 15-min W-formations could result in some meanwhile demand in the coming sessions: