- USD/JPY Price Analysis: Bears in control ahead of Tokyo, eye 142.50 then 141.50

Notícias do Mercado

USD/JPY Price Analysis: Bears in control ahead of Tokyo, eye 142.50 then 141.50

- USD/JPY bears eye a move to the 141.50s for the day ahead.

- The price is carving out a bearish structure on the hourly time frame but 142.50 will be key.

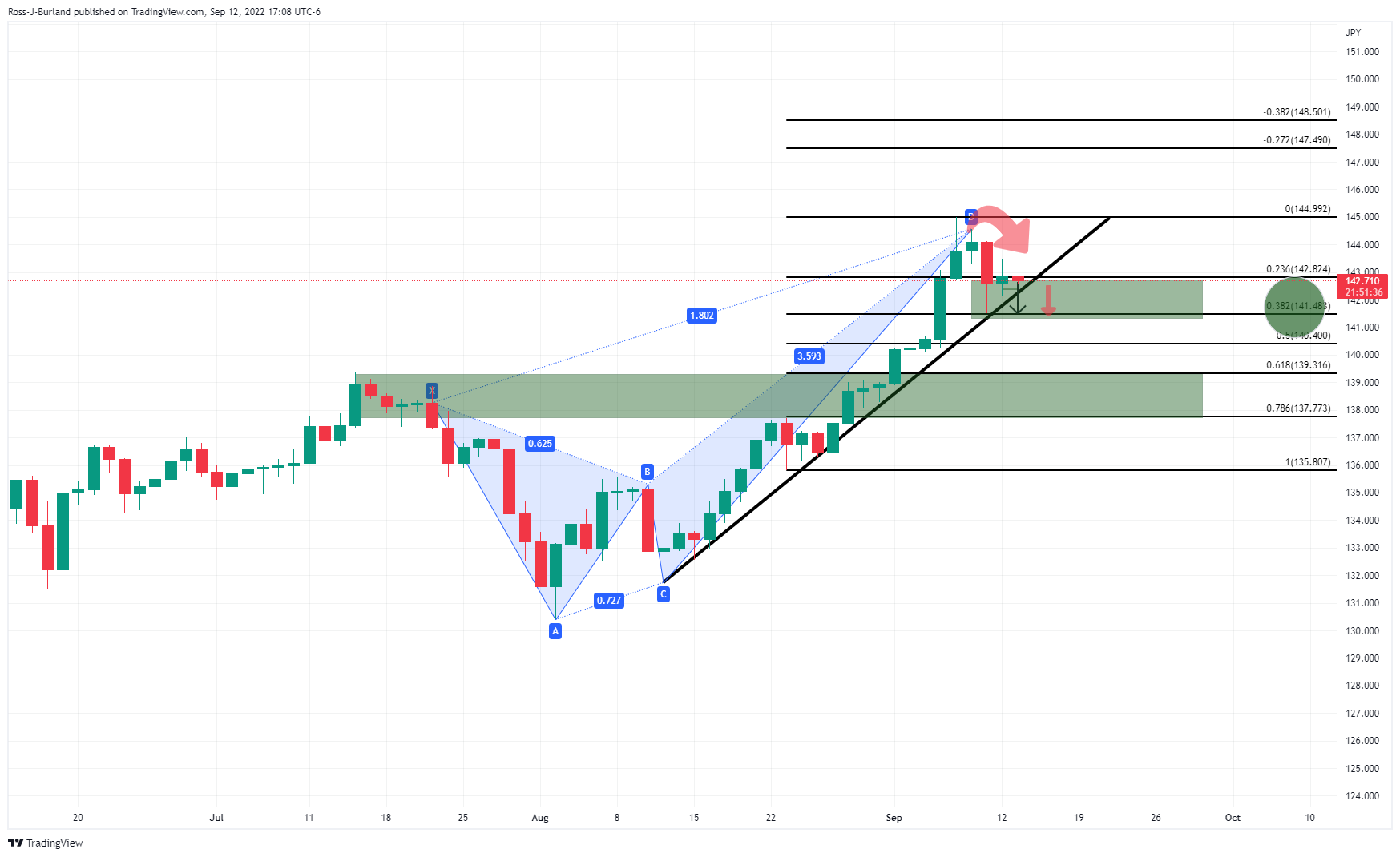

USD/JPY is being pressured ahead of the Tokyo open as it moves below the upper quarter level of the 142 area. The bears are engaging and have their sights on a correction towards the hourly W-formation support and then a key trendline support thereafter. The following illustrates the bearish thesis across both the daily and hourly time frames.

USD/JPY daily chart

The daily harmonic pattern is bearish and the price is starting to chip away at the trendline support following a deceleration of the bullish impulse. The 38.2% Fibonacci should be an important level of support for the sessions ahead should bears maintain control below 142.75.

USD/JPY H1 chart

The hourly charts show that the price is correcting from the prior bullish rally and is filling the wick left behind by the prior bearish hourly bar. A continuation lower in the Tokyo session will complete a move to the neckline of the W-formation. This is the first defence on the way into the daily 38.2% Fibonacci targets near 141.50.