- Crude Oil Futures: Further consolidation on the cards

Notícias do Mercado

19 setembro 2022

Crude Oil Futures: Further consolidation on the cards

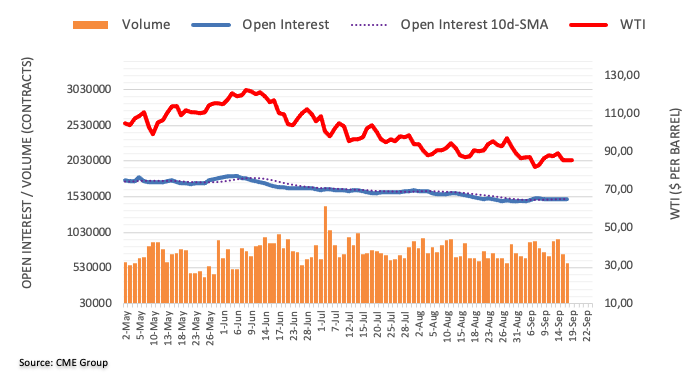

CME Group’s flash data for crude oil futures markets noted traders added just 613 contracts to their open interest positions on Friday, reversing two consecutive daily drops. Volume, instead, shrank for the second session in a row, this time by around 123.7K contracts.

WTI: A drop to $81.21 is not ruled out

Prices of the WTI charted an inconclusive session at the end of last week amidst a small uptick in open interest and shrinking volume. That said, extra range bound appears favoured in the very near term, although a potential drop to the multi-month lows near the $81.00 mark per barrel (September 8) should not be ruled out.

O foco de mercado

Abrir Conta Demo e Página Pessoal