- NZD/USD Price Analysis: Bulls are making their moves but resistance looms

Notícias do Mercado

NZD/USD Price Analysis: Bulls are making their moves but resistance looms

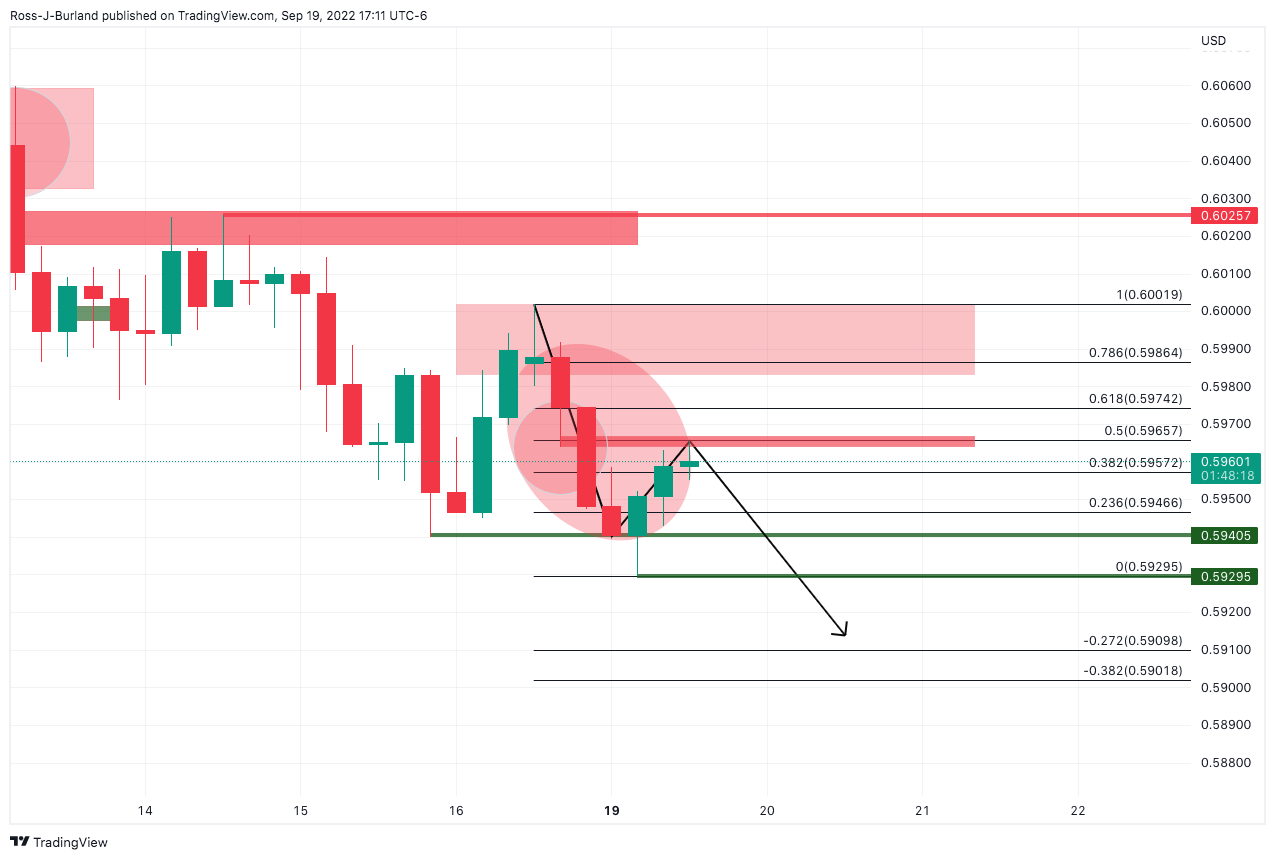

- NZD/USD bulls take on the offers around the 50% mark.

- 61.8% ratio has a confluence with a structure that could be the last defense ahead of a significant push from the bulls to challenge the prior swing highs.

The Kiwi is correcting from a key support area following a solid move to the downside and rejection from a critical resistance. As per the prior analysis, NZD/USD Price Analysis: Bulls take control ahead of the Fed, but bears could pounce, the bears moved in and the following illustrates prospects for a downside continuation.

NZD/USD H4 prior analysis

NZD/USD updates

The 4-hour chart sees the price rejected at a prior low in a creeping correction to the 50% mean reversion mark. Should resistances start to play in, there will be prospects for a downside continuation for the week ahead.

The hourly chart is attempting to take on the offers around the 50% mark in the latest move from support. Beyond the 50% mark, the 61.8% ratio has a confluence with a structure that could be the last defense ahead of a significant push from the bulls to challenge the prior swing highs.