- EUR/GBP Price Analysis: Hovers around 0.8940 after trimming Monday’s gains

Notícias do Mercado

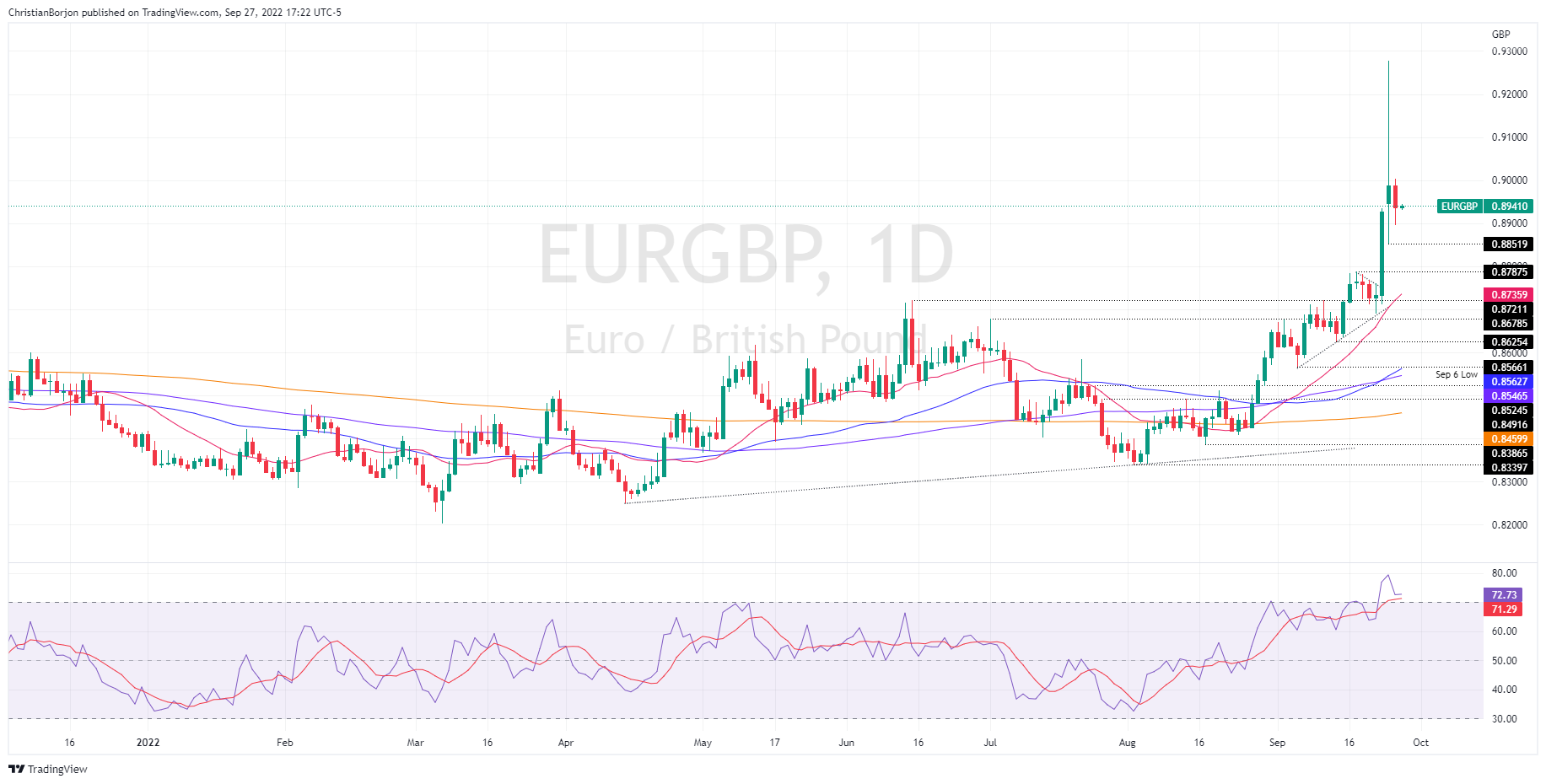

EUR/GBP Price Analysis: Hovers around 0.8940 after trimming Monday’s gains

- As volatility decreased on Tuesday, EUR/GBP fell below 0.9000, which witnessed the cross jumping to a new one-and-a-half year high.

- The EUR/GBP formed a “bearish harami” candle pattern, which suggests sellers are gathering momentum.

- A break below 0.8896 would open the door towards the 0.8700 region; otherwise, a re-test of the 0.9000 figure is on the cards.

The EUR/GBP tumbles below the 0.9000 mark for the first time in the week after hitting a weekly high at 0.9254 on Tuesday, courtesy of growing fears about the UK’s “mini-budget” presented by the new UK Chancellor of the Exchequer Kwasi Kwarteng. However, investors’ worries have eased, and at the time of writing, the EUR/GBP is trading at 0.8938, slightly above its opening price.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP remains neutral to upward biased, though, after Monday’s monstrous 400-pip rally, which printed a fresh one-year and-half high at 0.9254, the pair was subject to a mean reversion move. Therefore, the EUR/GBP reversed some of its gains on Tuesday. Even though the EUR/GBP formed a “bearish harami” candle pattern, a break below the September 26 low at 0.8851 is needed to extend its losses further.

Therefore, the EUR/GBP’s first support would be the September 27 daily low at 0.8896. Once cleared, the next support would be the 0.8851 cycle low mentioned above, followed by a drop towards the September 19 daily high-turned-support at 0.8787.

Contrarily, if the EUR/GBP breaks above 0.9000, a re-test of the 0.9100 figure is on the cards, ahead of 0.9200, followed by the YTD high at 0.9254.

EUR/GBP Key Technical Levels