- Crude Oil Futures: Further gains not favoured

Notícias do Mercado

28 setembro 2022

Crude Oil Futures: Further gains not favoured

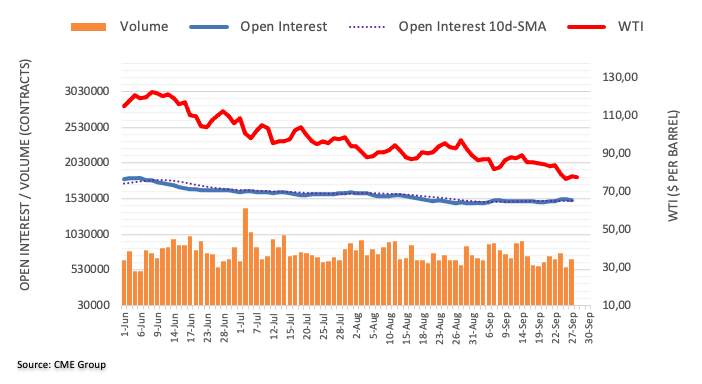

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions by around 11.8K contracts on Tuesday, adding to the previous daily pullback. Volume, instead, remained choppy and went up by around 112.3K contracts.

WTI keeps targeting the 2022 low near $74.00

WTI prices attempted a mild rebound on Tuesday. The uptick, however, was accompanied by shrinking open interest, which removes strength from a potential continuation of the recovery and leaves the commodity vulnerable to extra losses in the very near term. Next on the downside now emerges the YTD low near the $74.00 mark per barrel (January 3).

O foco de mercado

Abrir Conta Demo e Página Pessoal