- EUR/USD: Bulls face a tough hurdle at the parity zone

Notícias do Mercado

EUR/USD: Bulls face a tough hurdle at the parity zone

- EUR/USD falters once again near the parity level.

- Germany’s trade surplus surprised to the downside in August.

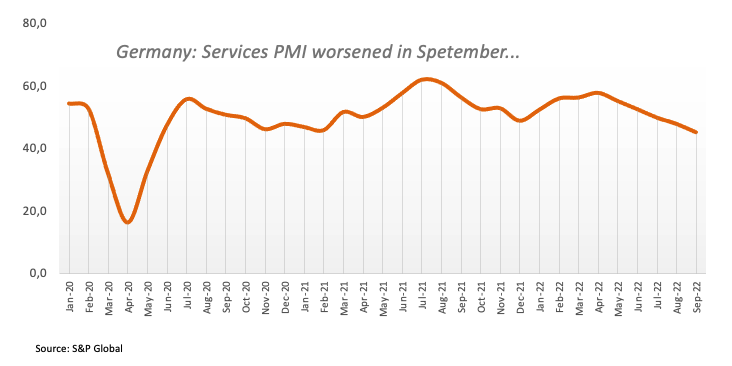

- Germany final Services PMI came at 45.0 in September.

Investors seem to be cashing up part of the recent strong advance and drag EUR/USD back to the mid-0.9900s so far in the European morning.

EUR/USD remains capped by the parity region

After two consecutive daily advances, EUR/USD now comes under some moderate selling pressure on the back of the marked bounce in the demand for the greenback.

Indeed, the USD Index (DXY) manages to regain some upside traction after bottoming out near the 110.00 mark – or 2-week lows – amidst the modest recovery in US and German yields.

Data wise in the Euroland, Germany’s trade surplus shrank to €1.2B in August and Industrial Production in France expanded more than expected 2.4% MoM also in the same period. In addition, final results saw the Services PMI in Germany ease to 45.0 and 48.8 when it comes to the broader euro bloc.

Across the ocean, MBA Mortgage Applications, the ADP Employment Change Report, Balance of Trade, final S&P Global Services PMI and the ISM Non-Manufacturing are all due later in the NA session. On the Fed’s side, Atlanta Fed R.Bostic is also due to speak.

What to look for around EUR

EUR/USD’s acute rebound has so far met quite a firm resistance near the key parity zone.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The latter has been exacerbated further following the latest rate hike by the Fed and the persevering hawkish message from Powell and the rest of his rate-setters peers.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: Germany Balance of Trade, EMU, Germany Final Services PMI (Wednesday) – Germany Construction PMI, EMU Retail Sales, ECB Accounts (Thursday) – Germany Retail Sales (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian post-elections developments. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.45% at 0.9939 and faces the immediate contention at 0.9535 (2022 low September 28) ahead of 0.9411 (weekly low June 17 2002) and finally 0.9386 (weekly low June 10 2002). On the other hand, the breakout of 0.9999 (weekly high October 4) would target 1.0030 (55-day SMA) en route to 1.0050 (weekly high September 20).