- GBP/USD Price Analysis: Bears ready to pounce and eye 1.0900, but NFP matters most

Notícias do Mercado

GBP/USD Price Analysis: Bears ready to pounce and eye 1.0900, but NFP matters most

- GBP/USD bears are lurking and eye a run into the 1.0900s.

- The focus will be on the US NFP data and how US yields and the US dollar react.

GBP/USD has been sold heavily towards the remaining sessions of the week. On Thursday, the bears moved in below the countertrend line on the hourly chart.

The price moved into the low 1.1100s with the groundwork being done in London. Traders in the US session finished off what the bears started in Europe and there could be more to come depending on the outcome of Friday's key US event in Nonfarm Payrolls:

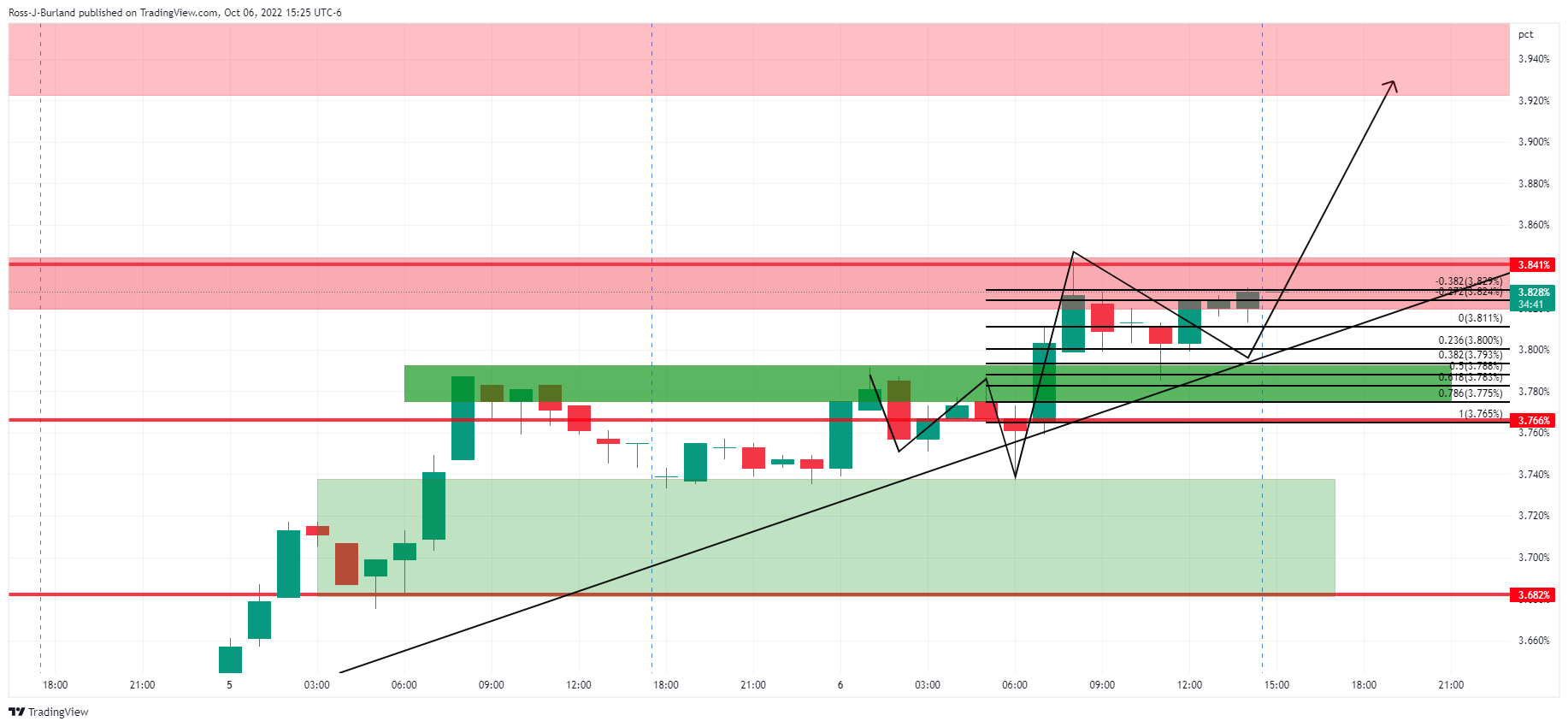

US 10-year yield H1 charts

The W-formation, zoomed in, is bullish as price meets support at the neckline. This is a bearish scenario for cable.

DXY H1 chart

Despite downbeat Initial Jobless Claims, the DXY index, which measures the US dollar vs a basket of currencies, including the pound, rose and extended its gains from the previous day.

On Thursday, the greenback is back above 112.00, recovering from when it was initially falling against most majors at the start of the week before regaining ground. The question here is whether it can extend the gains towards the high of the week through 112.50. If Friday's NFP is terrible, then the 111 level will potentially come under pressure, whereas if the data is in line, it will be another disappointment for those looking for a Fed pivot and positive for the greenback, bearish for GBP:

GBP/USD weekly chart

The price has come up to test the trendline in a strong move through key Fibonacci levels. However, there is a daily price imbalance, as per the greyed area and while below resistance, the focus remains on the downside.

GBP/USD daily chart

On the other hand, should the bears stay the course and a bullish outcome for the US dollar in today's Nonfarm Payrolls, then the following illustrates the prospects of a move into the 1.0900s according to the hourly structure: