- NZD/USD Price Analysis: Bulls eye 0.5580s

Notícias do Mercado

NZD/USD Price Analysis: Bulls eye 0.5580s

- NZD/USD bulls could be back in play for the day ahead.

- The bulls eye a return to the middle of the sell-off.

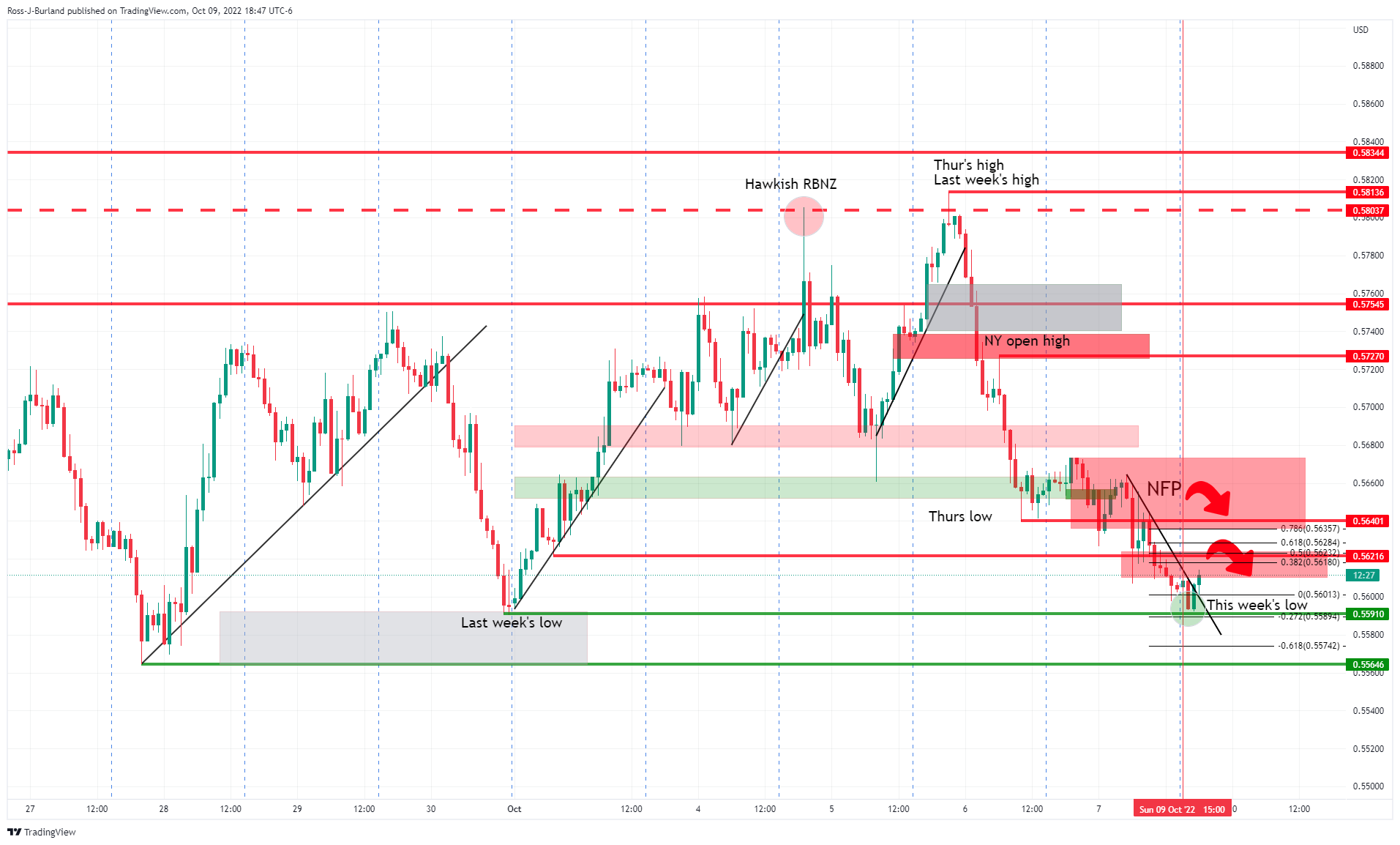

As per the prior day's analysis, the price has moved lower and we start the middle of the week on the back foot. The Kiwi is at a new cycle low ahead of key US Consumer Price Index data on Thursday night.

The driving force is US rates but the inflation risks in New Zealand could be contained by a hawkish central bank, offering support tot he bird. this gives rise to prospects of a correction for the day ahead in NZD/USD as the following analysis leans towards.

Prior analysis, NZD/USD

The price was attempting to slide out of the resistance of the dynamic bearish trendline that was formed on the back of the NFP data on Friday and that the bulls needed to clear 0.5625 to put a firm grip on the baton:

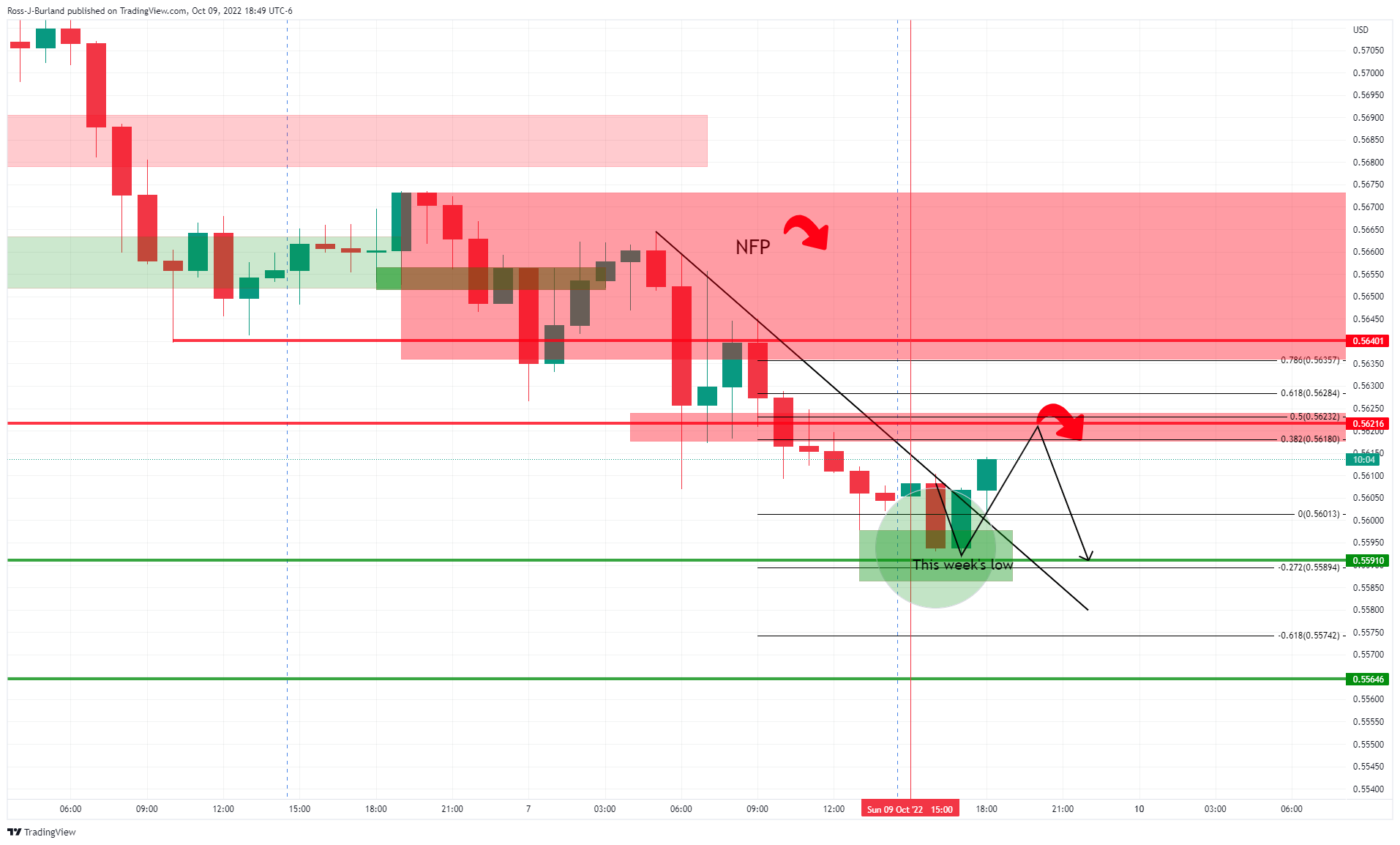

NZD/USD update, M15 chart

However, as the analysis illustrated if the bulls were unable to get above there, then the downside would be in play and that is what we got. The price sank, as expected, and the question now is whether this is going to be the high or low for the week. Given the number of catalysts on the calendar, perhaps not. However, in the meanwhile, the double bottom could be significant, at least for the Asian day ahead on Wednesday.

A break of the dynamics trendline resistance could be an opportunity for traders to look for a discount and target a significant correction towards the midpoint of the day's range near 0.5585 on a break of 0.5575. Bearish below 0.5550.