- ECB Villeroy: ECB should reach neutral rate close to 2% by end year

Notícias do Mercado

ECB Villeroy: ECB should reach neutral rate close to 2% by end year

ECB member and Bank of France's head Francois Villeroy de Galhau said they should reach a neutral rate of close to 2% by the end year and said a discussion about 50 bps or 75 bps hike in October is premature amid volatile markets.

"It would not be consistent to keep a very large balance sheet for too long in order to compress the term premium, whilst at the same time contemplating tightening policy rates above neutral," the French central bank governor told an audience at Columbia University.

"The reimbursement of TLTROs comes first, and we should avoid any unintended incentives to delay repayments by banks," he said.

"Here we could start earlier than 2024, maintaining partial reinvestments but at a gradually reduced pace," he said.

He argued the ECB should start this unwind slowly and then accelerate, with a clearly communicated "end-point...in terms of both the terminal date and size".

Meanwhile, the safe-haven US dollar has gained in a second day while the International Monetary Fund says warns of global recession and has cut its 2023 global growth forecasts further:

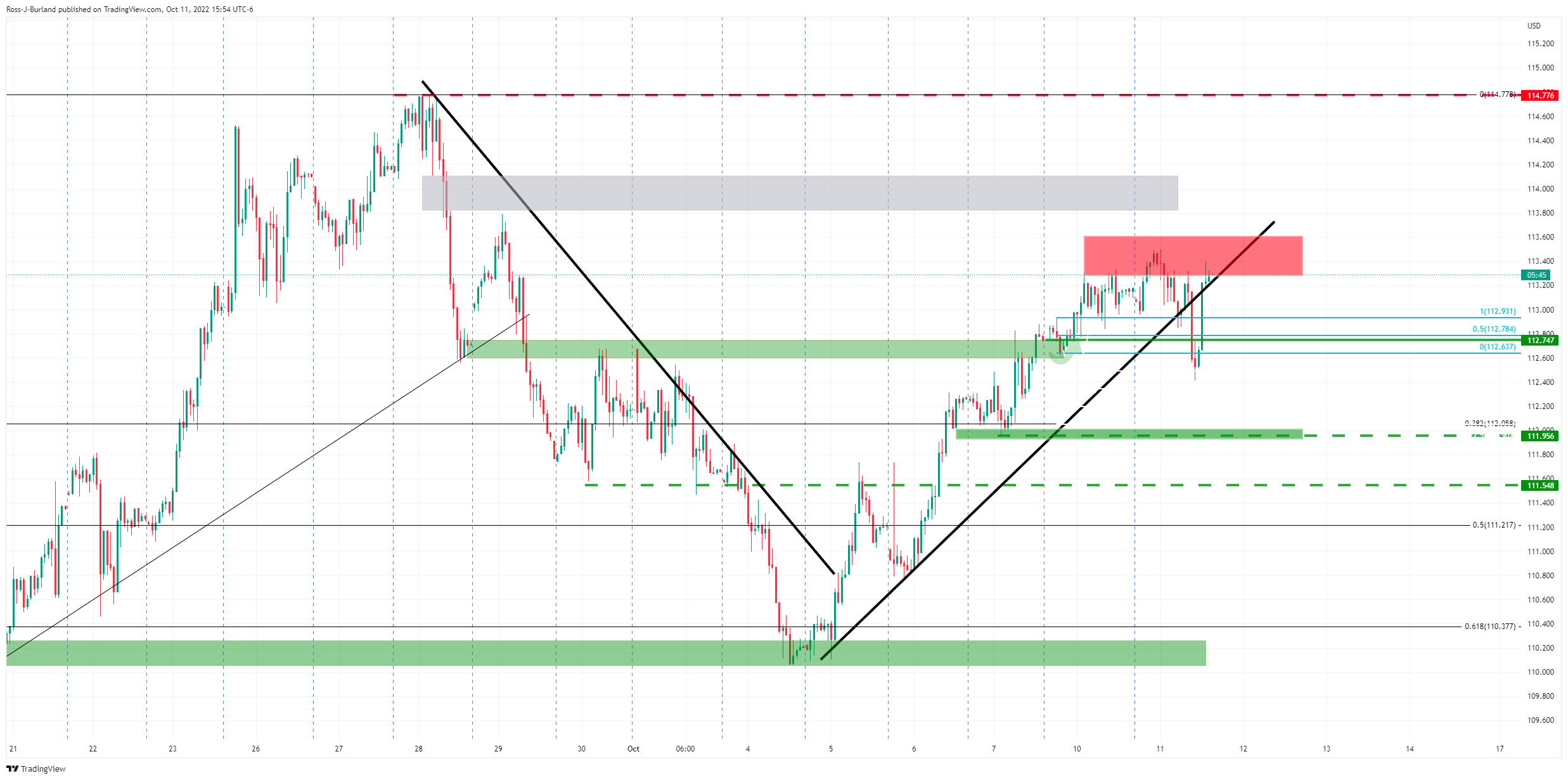

The euro, as a consequence, is pressured below 0.9750: