- Crude Oil Futures: Rebound appears unconvincing

Notícias do Mercado

14 outubro 2022

Crude Oil Futures: Rebound appears unconvincing

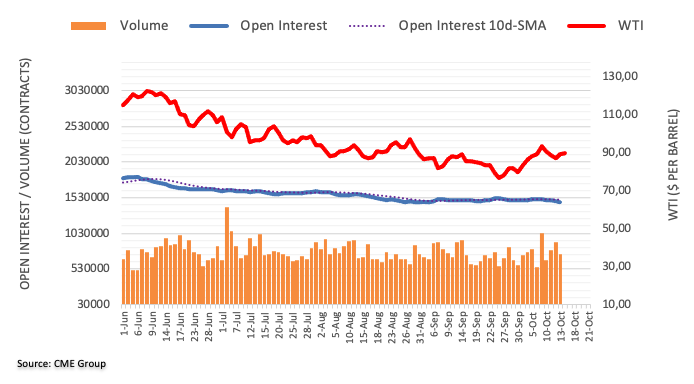

Open interest in crude oil futures markets shrank for the second session in a row on Thursday, now by around 9.2K contracts according to preliminary readings from CME Group. In the same line, volume reversed two consecutive daily builds and went down by nearly 158K contracts.

WTI poised to resume the downside

Thursday’s decent bounce in prices of the WTI was on the back of shrinking open interest and volume, which is supportive that extra strength looks not favoured in the current context. Against that, the continuation of the downside bias seen in the first half of the week seems probable in the very near term.

O foco de mercado

Abrir Conta Demo e Página Pessoal