- EUR/GBP Price Analysis: Bears have an upper-hand below 0.8700

Notícias do Mercado

EUR/GBP Price Analysis: Bears have an upper-hand below 0.8700

- EUR/GBP retreats from support-turned-resistance, grinds lower of late.

- Looming bull-cross on MACD contrasts with downbeat RSI to confuse sellers.

- Bulls need to cross 0.8800 to retake control.

EUR/GBP struggles to extend the week-start losses, grinding around an intraday low of 0.8651 during the initial hour of Monday’s Asian session. In doing so, the cross-currency pair reverses from the six-week-old previous support line to extend the previous week’s losses.

However, the MACD appears to test the bears and sluggish RSI adds to the trading filter, which in turn suggests further hardships for the bears.

That said, the latest trough surrounding 0.8610 lures intraday sellers before highlighting September’s bottom of 0.8566.

It should be noted, though, that a clear downside break of 0.8566 won’t hesitate to challenge the mid-August peak close to 0.8510 before directing the EUR/GBP bears towards the 0.8340 mark comprising the August month’s bottom.

Alternatively, recovery moves not only need to cross the support-turned-resistance line, around 0.8705 by the press time, but also the 61.8% Fibonacci retracement level of August 17 to September 26 upside, at 0.8718 by the press time, to tease the buyers.

Even so, a convergence of the 13-day-old descending trend line and 50% Fibonacci retracement level, around 0.8800 appears a tough nut to crack for the EUR/GBP bulls before they can retake control.

EUR/GBP: Four-hour chart

Trend: Further weakness expected

GBP/USD

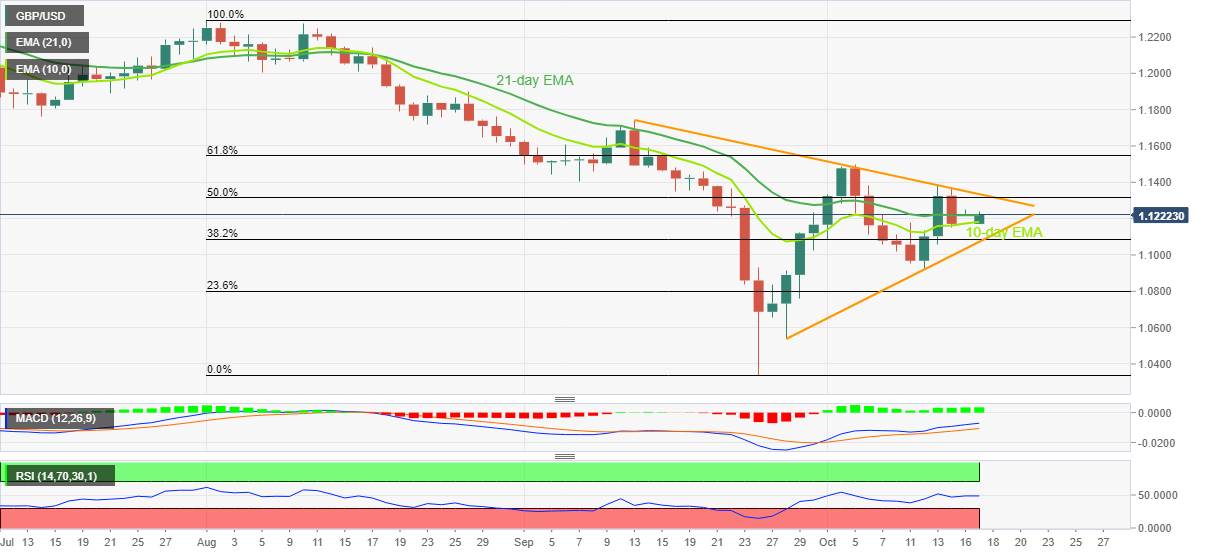

Alternatively, GBP/USD struggles to extend week-start gains as it grinds higher of late. That said, firmer oscillators and sustained trading beyond 10-day EMA favor buyers. It should be noted, however, that a five-week-old resistance line near 1.1340 appears the key hurdle while bears need to conquer 1.1085 to return to the throne.

Also read: GBP/USD propped up in pre-open APAC on BoE Bailey weekend comments

GBP/USD: Daily chart

Trend: Limited upside expected