- Japan's Finance Minister Suzuki: We are keeping a close eye on the FX market with a sense of urgency

Notícias do Mercado

Japan's Finance Minister Suzuki: We are keeping a close eye on the FX market with a sense of urgency

Japan's finance minister, Shun'ichi Suzuki said that they are we are keeping a close eye on the fx market with a sense of urgency.

Suzuki said they cannot tolerate excessive fx moves driven by speculators

He said he won't comment on whether conducting stealth fx intervention but that they will respond appropriately to excessive fx moves

''Generally speaking, there are times when we disclose the fact that we intervened in the fx market but some other times we don't.''

Meanwhile, Haruhiko Kuroda, governor of the Bank of Japan will be speaking shortly, 00.50 GMT. He will speak before parliament and would be expected to jawbone the currency higher.

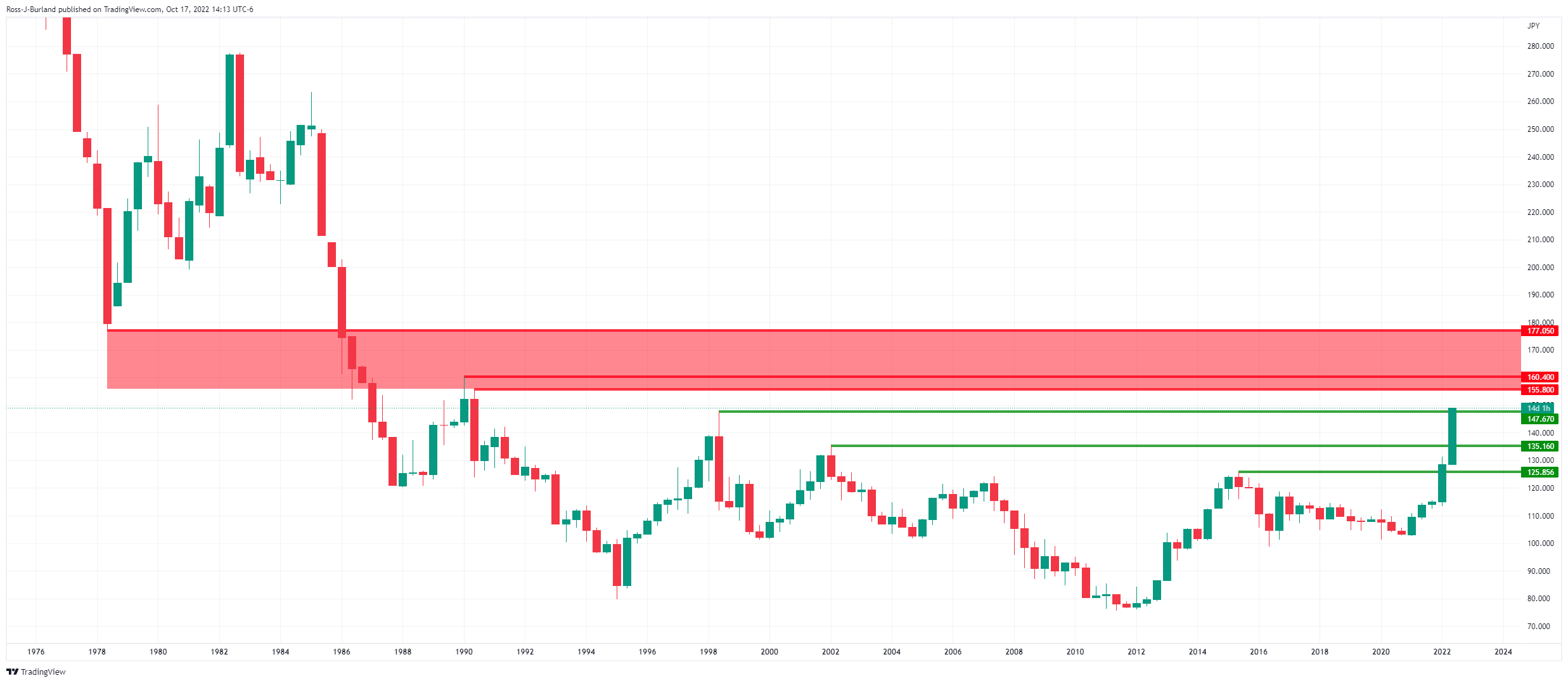

USD/JPY rallied to fresh bull cycle highs on Monday, touching 149.08.

The yen has declined nearly 30% against the dollar this year already as the divergence between the US Federal Reserve's hawkish stance and the Bank of Japan's ultra-lose policy. Last month, Japanese authorities conducted their largest-ever currency intervention to support the rapidly falling yen, having spent 2.84 trillion yen for its efforts which yielded a fleeting effect.