- EUR/USD Price Analysis: Bears on the prowl below key 61.8% Fibo

Notícias do Mercado

EUR/USD Price Analysis: Bears on the prowl below key 61.8% Fibo

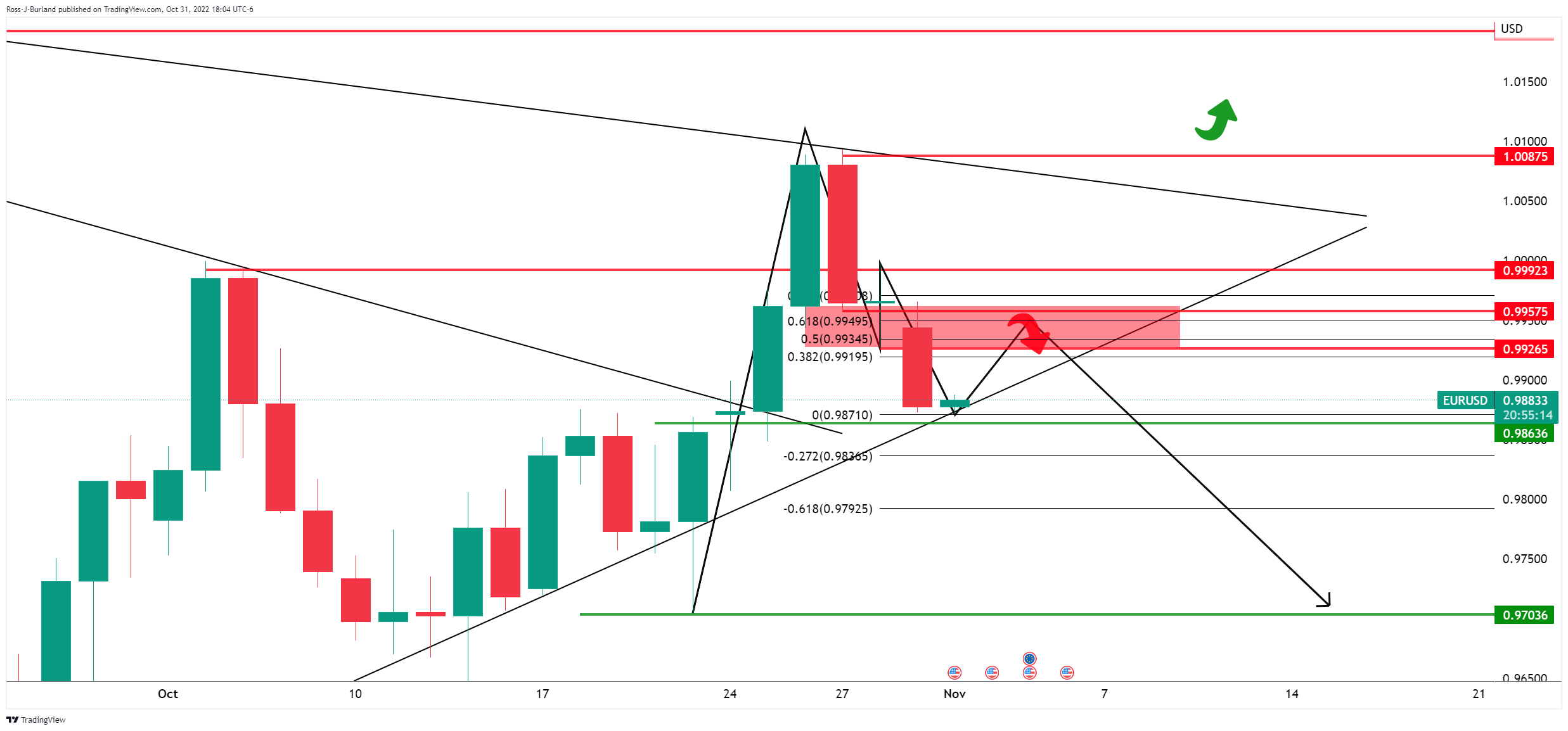

- EUR/USD bulls eye a run through a key 61.8% Fibo while bears eye a break of structure.

- 0.9860 is a key hurdle for the bears that is yet to give out.

EUR/USD has been attempting to break to the upside but failures have seen the pair stuck within familiar ranges in a short squeeze towards 1.0090. The US dollar has been a performer at the start of the week but is yet to seriously dent the structure of the market while above 0.9860 support vs. the euro. The following illustrates the prospects of a breakout one way or the other in the build-up to the Federal Reserve this week.

EUR/USD daily charts

The price has carved out an M-formation within the symmetrical triangle which leaves bias to the downside so long as the neckline of the M-formation holds over the coming sessions:

A break above the 61.8% Fibonacci, on the other hand, could be a sign of strength from the bulls and would leave the prospects of an upside breakout back on the cards. A target of 1.0090 and then 1.0190 would be a compelling feature should these levels also give out. On the downside, bears will be in control o a break of the 0.9540s.