- AUD/USD Price Analysis: Bears are in control ahead of the Fed, eyes on a break of key structure

Notícias do Mercado

AUD/USD Price Analysis: Bears are in control ahead of the Fed, eyes on a break of key structure

- AUD/USD bears stay on top as the price meets key support,

- The bears eye a break to test critical structure on the downside.

AUD/USD is under pressure despite the expectation that the Federal Reserve will signal a slower pace of tightening at its upcoming meeting to assess the impact of its rate hikes on the economy. Nevertheless, investors widely expect the Fed this week to raise its benchmark overnight interest rate by 75 basis points (bps) to a range of 3.75% to 4.00%, the fourth such increase in a row. the following illustrates the technical picture in AUD/USD heading into the meeting.

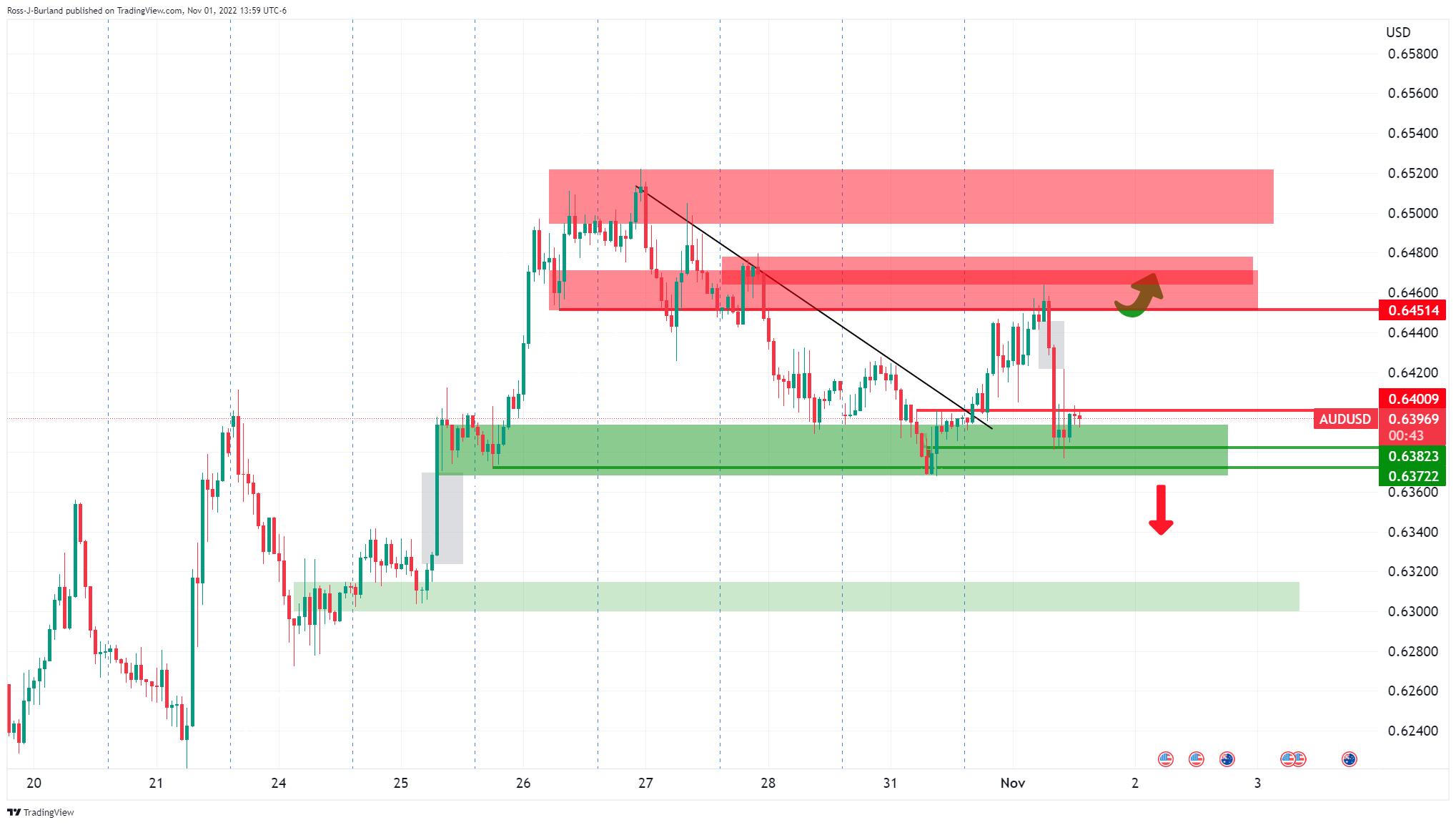

AUD/USD H1 chart

The price is accumulated on the backside of the trend and is vulnerable to a move higher should the support structure hold up over the course of the next day. On a break of the said support area, the bears will be back in control and will be looking for a fast move-in to test the next layer of support on the way to 0.63 the figure.

AUD/USD daily chart

On the daily chart, the price has dropped heavily into the demand area and there are prospects of a downside continuation as we head into the Federal Reserve in the coming hours while on the backside of the daily trendline.