- US dollar bulls fight back hard on Fed Powell's hawkish comments

Notícias do Mercado

US dollar bulls fight back hard on Fed Powell's hawkish comments

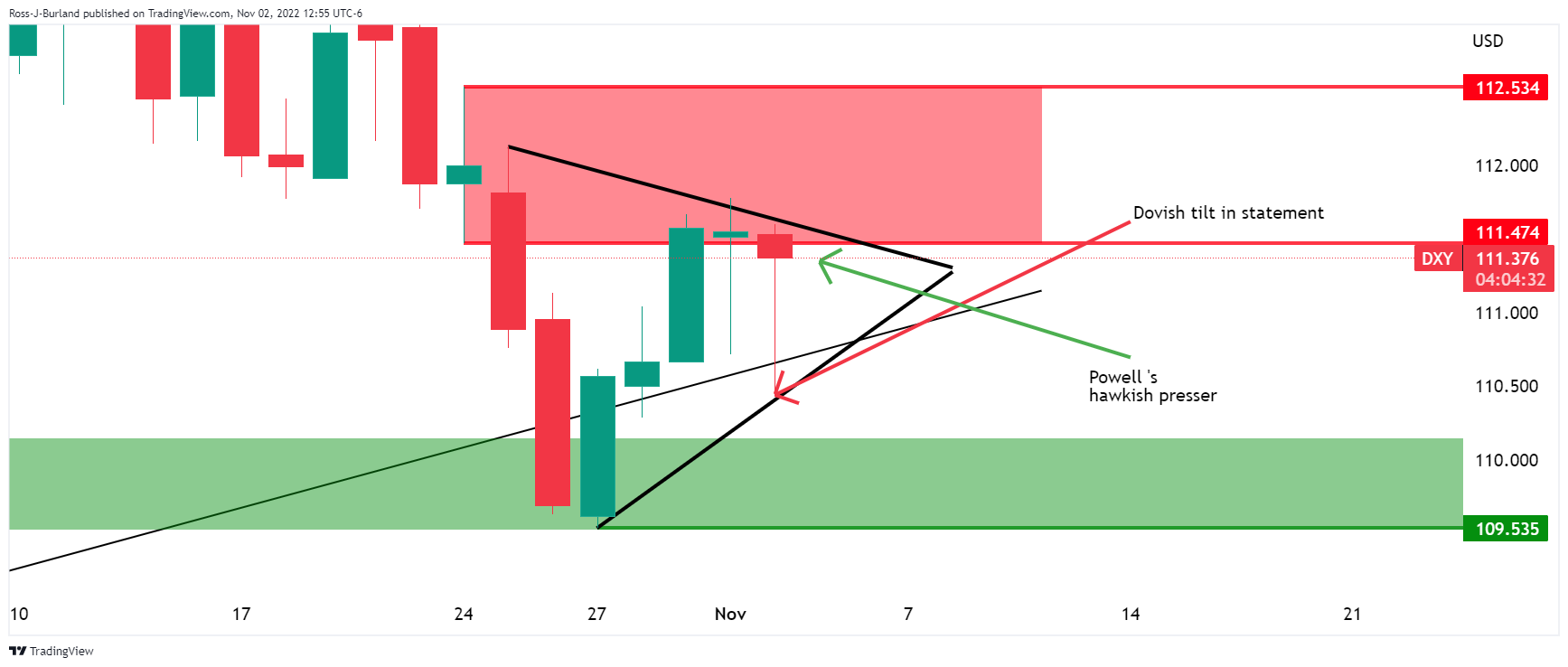

- FOMC dovish statement sent the US dollar lower but Fed's Powell's hawkish presser came to the rescue for the greenback.

- DXY is whipsawed and retraced close to 100% of the initial drop.

The US dollar has been whipsawed between a dovish FOMC statement followed by a hawkish delivery from Fed's Chair Jerome Powell who advocates for continued rate hikes with the potential to slow as soon as December, but without such a commitment to do so so soon.

At the time of writing, DXY, an index that measures the greenback vs. a basket of currencies, is trading at around 110.89 and has been traded between a post-FOMC statement high of 111.598 and 1110.426 the low.

Changes to FOMC statement

Firstly, DXY was offered heavily on the following in the statement: "In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations."

Before the FOMC statement, the terminal top was priced at 5.03% in May, it's down to 4.95% now after the new sentence in the FOMC statement that signals more increases but hints at possibly smaller increments.

The US dollar fell critical trendline support as shown on the hourly and daily charts below:

However, as the event progressed and Jerome Powell spoke, the dollar bounced back.

-

Powell speech: Will likely need restrictive stance of policy for some time

-

Powell speech: Longer-term inflation expectations are still well anchored

-

Powell speech: Will take time for full effects of monetary restraint to be realized

-

Powell speech: Time for slower hikes may come as soon as December or February

US dollar technical analysis

The daily outlook shows the price sandwiched between support and resistance.

The presser started out with a hawkish delivery from Powell which wiped out alomost 100% of the FOMC dovish statement drop.