- Gold Price Forecast: XAU/USD whipsawed on conflicting FOMC guidance

Notícias do Mercado

Gold Price Forecast: XAU/USD whipsawed on conflicting FOMC guidance

- The gold price has flipped over on the back of conflicting comments from the Fed's Chairman Powell.

- The bid that bulls enjoyed following a dovish statement was wiped out by Chair Powell's hawkish presser.

Gold has dropped back to the start again on the back of hawkish comments from the Federal Reserve's Chairman, Jerome Powell, that sent the 2-year Treasury yields higher when he said the ultimate rate level will be higher than previously expected. Markets had started to price in a slower pace of rate hikes based on the following from today's FOMS statement:

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations."

However, rates shot higher when Powell's hawkish comments at the presser dropped, sinking gold prices:

-

Powell speech: Very premature to be thinking about pausing

-

Powell speech: Will likely need restrictive stance of policy for some time

-

Powell speech: Longer-term inflation expectations are still well anchored

-

Powell speech: Will take time for full effects of monetary restraint to be realized

-

Powell speech: Time for slower hikes may come as soon as December or February

Gold & US dollar technical analysis

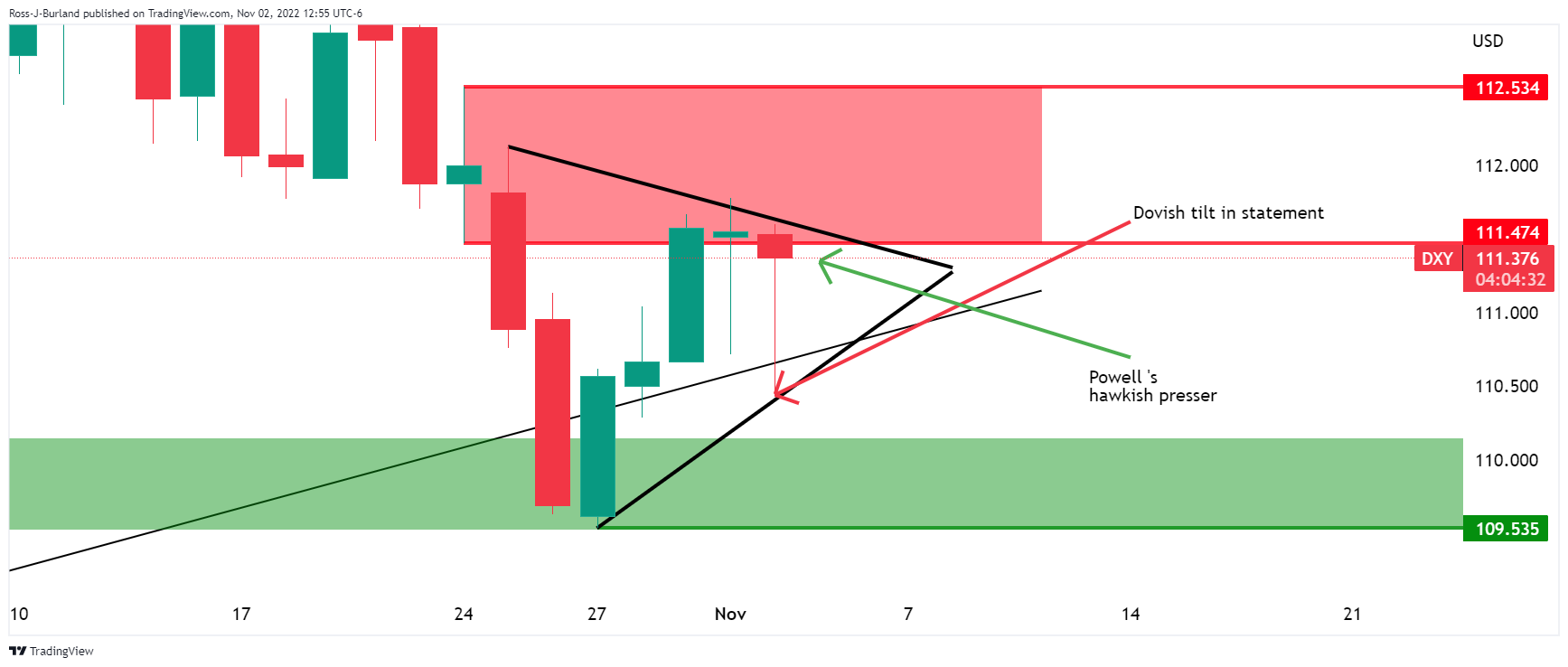

The daily gold chart above shows the price being whipsawed on the day as the US dollar battles back for ground on Powell's hawkish comments:

The daily outlook shows the US dollar price sandwiched between support and resistance.

The presser started out with a hawkish delivery from Powell which wiped out almost 100% of the FOMC dovish statement drop.