- Forex Today: Risk flows return following Monday's choppy action

Notícias do Mercado

Forex Today: Risk flows return following Monday's choppy action

Here is what you need to know on Tuesday, November 15:

As the market mood improves early Tuesday, the US Dollar is having a difficult time building on Monday's modest recovery gains. Reflecting the risk-positive market environment, US stock index futures are up between 0.4% and 0.7% in the European morning. The European economic docket will feature the third-quarter Gross Domestic Product figures alongside the September Trade Balance data and the ZEW sentiment survey. Later in the day, the Federal Reserve Bank of New York's Empire State Manufacturing Survey and October Producer Price Index (PPI) data from the US will be looked upon for fresh impetus.

Earlier in the day, the data from China revealed that Industrial Production grew by 5% on a yearly basis in October, falling short of the market expectation for an expansion of 5.2%. Additionally, Retail Sales contracted by 0.5% in the same period following September's growth of 2.5%. Despite the disappointing data releases, Hong Kong's Hang Seng gained more than 3% and the Shanghai Composite rose nearly 1.5% on the day amid renewed optimism about China softening coronavirus restrictions.

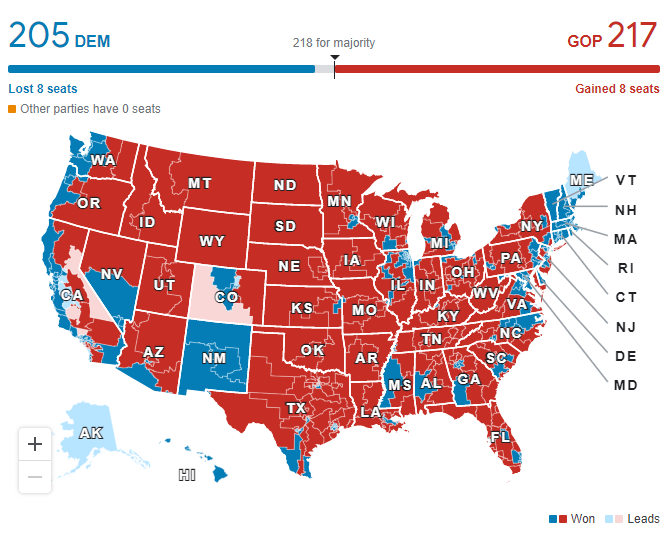

Meanwhile, Republicans remain on track to gain the majority in the House with 218 seats. According to the Associated Press, Republicans have secured 217 seats with 13 seats left to be decided.

Source: Associated Press

EURUSD staged a rebound late Monday and ended up closing the day unchanged above 1.0300. The pair stays relatively quiet and fluctuates below 1.0350 in the European morning.

GBPUSD trades modestly higher on the day at around 1.1800. The UK's Office for National Statistics reported that the ILO Unemployment Rate rose to 3.6% in September from 3.5% in August but this data was largely ignored by market participants.

Although the US Dollar is struggling to find demand on Tuesday, USDJPY clings to modest daily gains above 140.00. Earlier in the day, the data from Japan revealed that Industrial Production contracted by 1.7% on a monthly basis in September, compared to the market expectation for a decrease of 1.6%.

Following a downward correction in the first half of the day, Gold price reversed its direction late Monday as the 10-year US Treasury bond yield stayed below the key 4% level. XAUUSD holds steady at around $1,770 in the European morning.

Bitcoin snapped a three-day losing streak on Monday but struggled to preserve its bullish momentum early Tuesday. BTCUSD trades in a narrow range at around $16,700 in the European morning. Ethereum continues to stretch higher after having closed in positive territory on Monday and it was last seen rising more than 2% on the day at $1,270.

US Treasury Secretary Janet Yellen believes FTX collapse exposed weaknesses in crypto.