- Crude Oil Futures: Further losses in store

Notícias do Mercado

24 novembro 2022

Crude Oil Futures: Further losses in store

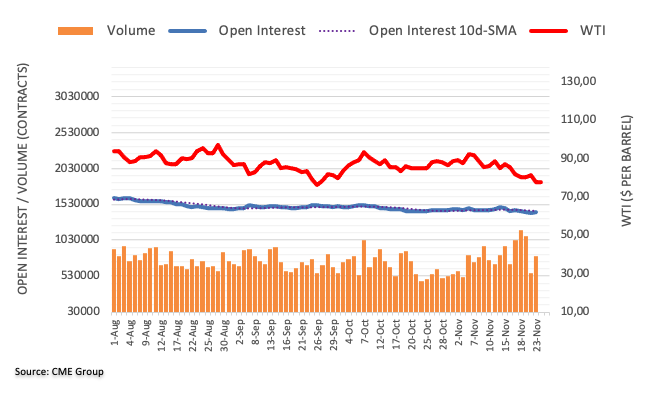

Considering advanced prints from CME Group for crude oil futures markets, traders added around 7.1K contracts to their open interest positions and reversed at the same time three daily pullbacks in a row. Volume followed suit and went up by more than 242K contracts after two consecutive daily drops.

WTI now targets the 2022 low near $74.00

Prices of the WTI dropped strongly and breached the key $80.00 mark per barrel on Wednesday. The sharp pullback was reinforced by increasing open interest and volume and signals that further weakness lies ahead in the very near term. That said, the WTI could slip back and revisit the YTD low at $74.30 (January 3).

O foco de mercado

Abrir Conta Demo e Página Pessoal