- Gold Price Forecast: $1,785 puts a floor under XAU/USD as Fed meeting, US inflation loom – Confluence Detector

Notícias do Mercado

Gold Price Forecast: $1,785 puts a floor under XAU/USD as Fed meeting, US inflation loom – Confluence Detector

- Gold price renews four-day high, approaches six-month-old resistance.

- US Dollar weakness joins China-linked optimism to favor XAU/USD bulls.

- Convergence of previous monthly high, golden ratio restricts downside ahead of US CPI, FOMC.

Gold price (XAU/USD) stays on the front foot for the fourth consecutive day as it cheers the broad-based US Dollar weakness to poke $1,800. Further, optimism surrounding China adds strength to the bullion’s run-up as traders await early signals for US inflation. It’s worth noting, however, that the cautious optimism ahead of next week’s Federal Open Market Committee (FOMC) meeting and the US Consumer Price Index (CPI) for November appears to challenge the Gold price. Considering the early signals, the Fed is likely to defend the policy hawks, despite suggesting a 0.50% rate hike, which in turn could keep the XAU/USD on the dicey floor and may allow the Gold buyers to retreat in case of US Dollar positive outcomes.

Also read: Since the Gold rally has stopped, can a reversal be expected?

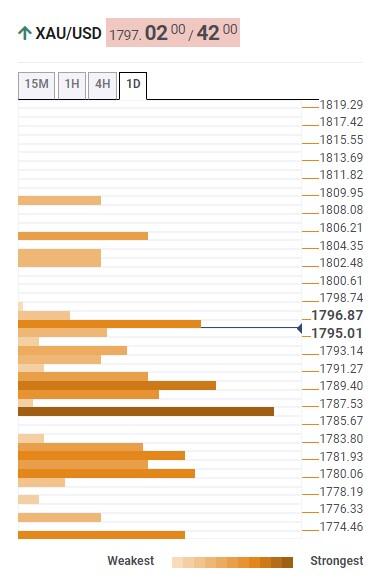

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the Gold price has fewer hurdles towards the north as it stays beyond the key $1,785 support comprising the previous month's high and Fibonacci 61.8% on daily formation, also known as the golden ratio.

That said, a convergence of the Fibonacci 23.6% on weekly and 38.2% on one day, around $1,791, also acts as short-term key support for XAU/USD.

It should be noted that a clear downside break of the $1,785 support confluence could quickly drag the quote toward the $1,780 mark encompassing 5-DMA and 38.2% on weekly formation.

In a case where the Gold price drops below $1,780, the 10-DMA and Fibonacci 161.8% on the one-day act as the last defense of buyers.

Alternatively, the previous weekly high surrounding $1,806 could test the Gold buyers, for now, before directing them to the Pivot Point one-day R3 near $1,810.

Following that, tops marked during the mid-June around $1,857 and June's monthly peak near $1,880 will be in focus.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.