- GBP/JPY Price Analysis: Bears cheer BOJ’s readiness to act, 200-DMA in focus

Notícias do Mercado

GBP/JPY Price Analysis: Bears cheer BOJ’s readiness to act, 200-DMA in focus

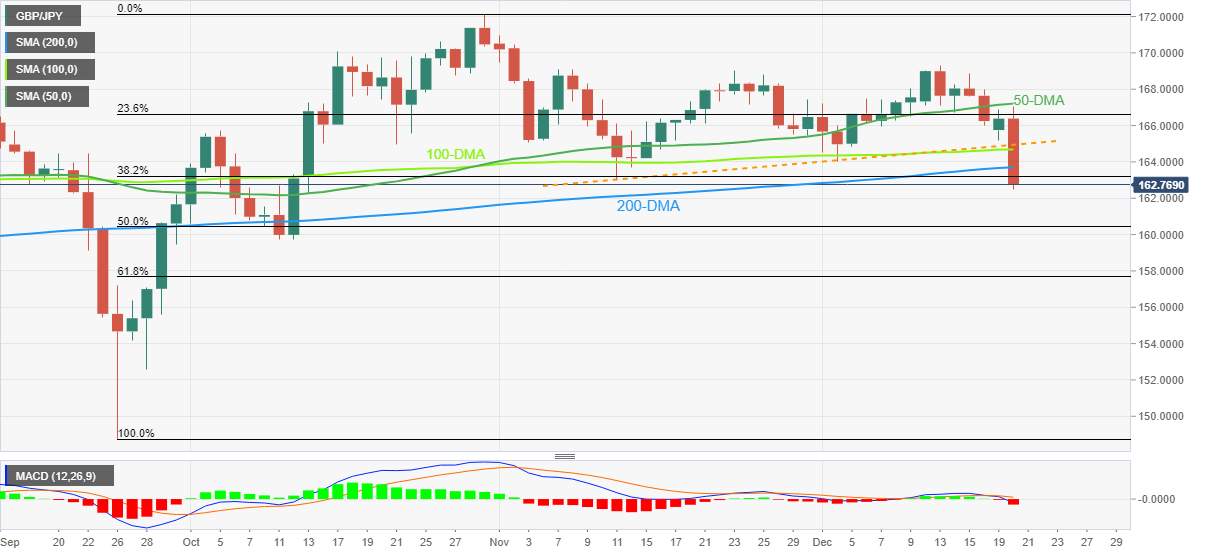

- GBP/JPY plummets to two-month low on BOJ’s inaction.

- Downside break of the key support line, 100-DMA joins bearish MACD signals to favor sellers.

- Daily closing below 200-DMA appears necessary to defend sellers.

- 50-DMA guards recovery moves, October’s low acts as additional downside filter.

GBP/JPY takes offers to test the lowest levels since October 12 after the Bank of Japan (BOJ) teased Yen buyers by showing readiness to act on Yield Curve Control (YCC) if needed. That said, the cross-currency pair slumped nearly 400+ pips following the announcements, down 2.0% near 163.00 by the press time of early Tuesday.

In doing so, the quote not only broke the 100-DMA but also smashed the previous key support line from November 11. It should be noted that the pair currently trades beneath the 200-DMA but needs a daily closing below the same to keep sellers on the table.

Given the bearish MACD signals and the fundamental moves, GBP/JPY is likely to stay below the 200-DMA support near 163.70, which in turn could help the bears to aim for October’s low near 159.75. However, the 160.00 round figure may act as an intermediate halt.

In a case where the GBP/JPY bears dominate past 159.75, the 61.8% Fibonacci retracement level of the pair's September-October recovery, near 157.70, will be in focus.

Meanwhile, a daily closing beyond the 200-DMA level of 163.70 could aim for the 100-DMA and support-turned-resistance line, respectively around 164.70 and 165.00.

Following that, the 50-DMA hurdle near 167.20 will act as the last defense for the bears.

GBP/JPY: Daily chart

Trend: Further downside expected