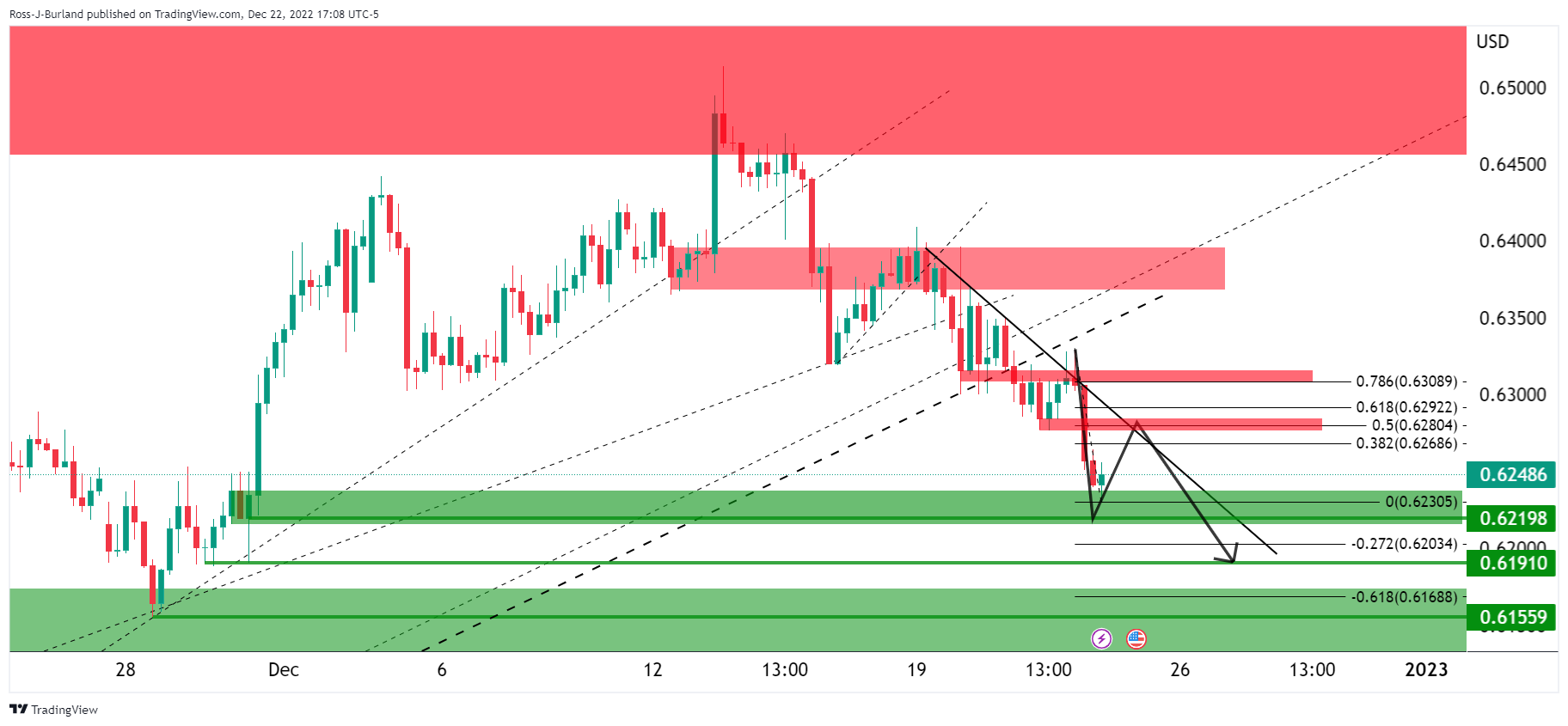

- NZD/USD Price Analysis: Bulls eye a 50% mean reversion to 0.6280

Notícias do Mercado

NZD/USD Price Analysis: Bulls eye a 50% mean reversion to 0.6280

- NZD/USD bears run into an area of support with a correction now on the cards.

- NZD/USD bulls eye a 50% mean reversion target that aligns with prior support.

As per the prior analysis, NZD/USD Price Analysis: Bears in charge and eye 0.6250, whereby the price was expected to continue lower, we have seen a resurgence in the US dollar that has subsequently knocked the bird off its perch and into the targeted area.

NZD/USD prior analysis

it was stated that the price had swept the liquidity near 0.64 in the form of stops and this had resulted in a move lower and a change of charter (CoCh MTF (multi time frame)) in structure, from bullish to bearish, on the lower time frames around 0.6370.

The price had crept into the targetted area in choppy market conditions. The bears needed to get below 0.6300. This was expected to take out critical trendline support and be the makings of a possible downside continuation for the rest of the year with 0.6250 eyed.

NZD/USD update

The price target was met in trade on Thursday and an upside correction could now be on the cards putting heat on to the breakout shorts from the 0.6300 area. A 50% mean reversion aligns with prior support near 0.6280.