- US Dollar Index Price Analysis: DXY bears approach key support near 104.00

Notícias do Mercado

US Dollar Index Price Analysis: DXY bears approach key support near 104.00

- US Dollar Index takes offers to extend three-day downtrend.

- Two-week-old ascending support line, oversold RSI conditions challenge immediate downside.

- Sellers need validation from 103.75 before eyeing the monthly low.

- Key HMAs, weekly resistance line probe DXY bulls.

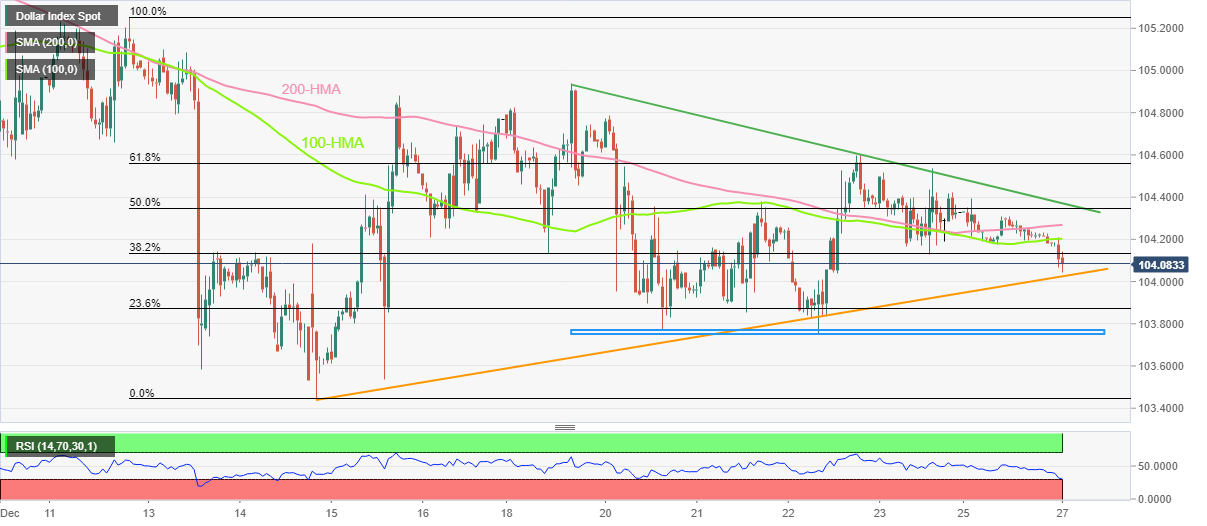

US Dollar Index (DXY) remains pressured towards a two-week-old support line as it drops to 104.08 during early Tuesday. In doing so, the greenback’s gauge versus the six major currencies declines for the third consecutive day.

That said, the DXY’s recent downside past the 100-Hour Moving Average (HMA) joins the previous U-turn from a one-week-old descending resistance line to keep bears hopeful. However, the oversold RSI (14) conditions challenge the quote’s further downside.

As a result, an upward-sloping support line from December 14, close to the 104.00 round figure by the press time, restricts the quote’s immediate downside.

Following that, the lows marked during the last Tuesday and Thursday around 103.75 may probe the DXY bears.

In a case where the US Dollar Index declines below 103.75, the odds of witnessing a fresh monthly low, currently around 103.45, can’t be ruled out.

On the flip side, the 100-HMA level of 104.20 precedes the 200-HMA surrounding 104.30 to restrict the quote’s recovery moves ahead of a one-week-old descending resistance line, close to 104.40 at the latest.

Should the quote remains firmer past 104.40, the 105.00 threshold could act as the key hurdle to the north for the US Dollar Index bulls.

US Dollar Index: Hourly chart

Trend: Limited downside expected