- GBP/USD bears move in at critical resistance, now test key dynamic support, 1.2250 eyed

Notícias do Mercado

GBP/USD bears move in at critical resistance, now test key dynamic support, 1.2250 eyed

- GBP/USD momentarily bid on United Kingdom's Consumer Price Index and weak United states economic data.

- The British Pound reached critical highs before a fade to test key technical dynamic support.

- Bank of England and Federal Reserve sentiment in the hot seat.

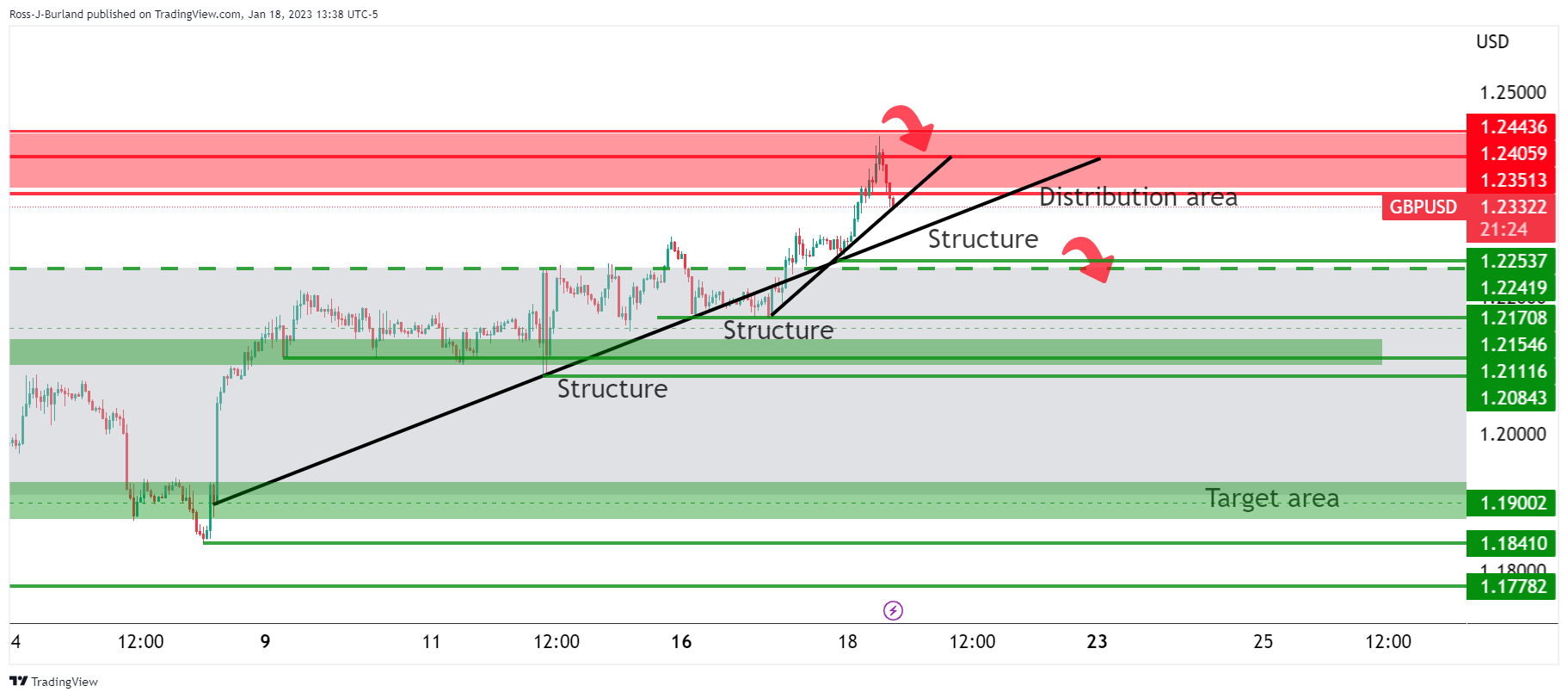

- GBP/USD's micro-trendline support guards structure around 1.2250 and then 1.2170.

The GBP/USD bulls got what they wished for from the United Kingdom's Consumer Price Index that showed while inflation fell to a three-month low of 10.5% in December, it remains near 40-year highs. Specifically, the increase in services inflation and accelerating food and drink prices are a cause for some concern for the Bank of England's policy-makers.

GBP/USD, as per analysis written earlier in the week, was propelled towards last month's six-month high of 1.2446, reaching a high of 1.2435 on the day so far from a low of 1.2253. However, a recent rally in the US Dollar and softer US stocks are fuelling a sell-off in the pound currently, dragging the price a buck lower to $1.2345.

Given a gloomy domestic economic outlook and recession fears due to high inflation and a cost-of-living crisis, this may ultimately weigh on the British Pound. Nevertheless, a hawkish Bank of England could inject some resilience into the pound.

GBP/USD buoyed by Bank of England expectations

The Bank of England's Governor Andrew Bailey suggested earlier this week that a shortage of workers in the labour market posed a “major risk to inflation coming down”. ''The implication is that the Bank could remain more hawkish on its policy decisions this year,'' analysts at Rabobank said. ''We expect another 50 bps rate hike in February and then three more 25 bps moves as the Bank struggles to slice the final few percentage points from services sector inflation, which will be most impacted by wage growth,'' the analysts at Rabobank argued.

Analysts at ING Bank, commenting on today's consumer Price Index concur and said "it's important to note that core services jumped from 6.4% to 6.8%, a development that the BoE should particularly take into consideration, and when added to yesterday’s wage data should tilt the balance towards a 50 bps hike in February." Of note, the BoE has hiked interest rates nine times since December 2021 to try to lower inflation. Money markets are currently placing an 82% chance of a 50 bps rate hike at the next meeting, set for Feb 2.

US Dollar bid in midday US session

The US Dollar was injected with a bout of demand following hawkish comments from Federal Reserve officials that sparked worries that the central bank may not be pausing interest rate hikes any time soon. GBP/USD dropped with St. Louis Federal Reserve's President James Bullard saying US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

GBP/USD technical analysis

As per the prior analysis, GBP/USD bulls move in on a critical area on the charts ahead of the key Consumer Price Index, where GBP/USD was headed towards 1.24s resistance, the area was achieved but a fade on the rally was anticipated:

GBP/USD update

On the hourly time frame, GBP/USD's micro-trendline support guards structure around 1.2250. A break there will open the risk of a blow-off in GBP/USD to test 1.2170 and then 1.2080 structure.