- Aussie Retail Sales big miss weighs heavy on AUD/USD

Notícias do Mercado

Aussie Retail Sales big miss weighs heavy on AUD/USD

The primary gauge of Australia’s consumer spending, Retail Sales, is released as follows:

Australia Retail Sales (MoM) Dec: -3.9% (est -0.2%; prev 1.4%).

AUD/USD update

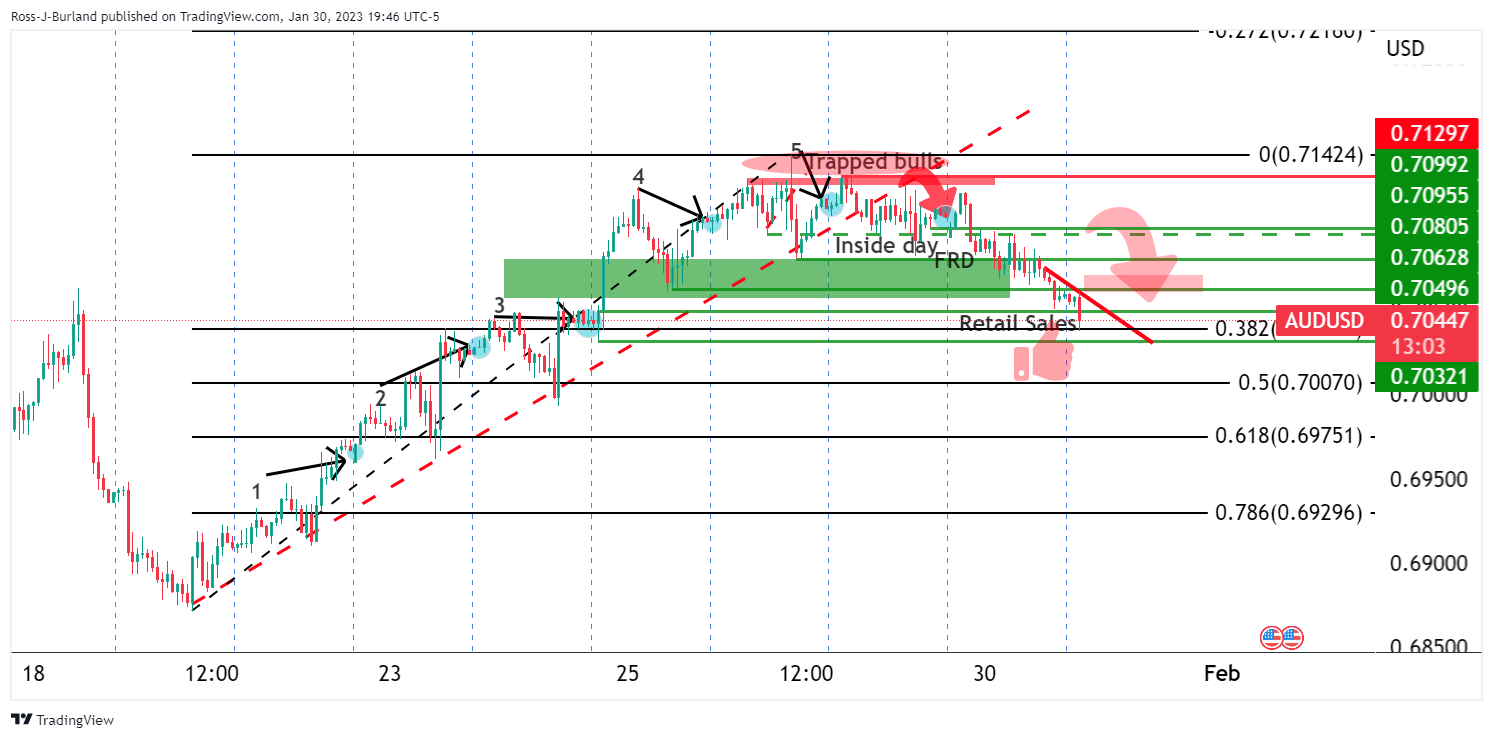

AUD/USD has been trying to break to the 38.2% Fibonacci as follows:

The data might just see the target reached as illustrated above. The analysis was drawn for the market open this week and has played out as a high-probability scenario considering the trapped volume as was explained in the following article: AUD/USD Price Analysis: Inside day Friday opens risk of a lower close on Monday, 0.7050 eyed

About Aussie Retail Sales

The data is released by the Australian Bureau of Statistics (ABS) about 35 days after the month ends. It accounts for approximately 80% of total retail turnover in the country and, therefore, has a significant bearing on inflation and GDP. This leading indicator has a direct correlation with inflation and the growth prospects, impacting the Reserve Bank of Australia’s (RBA) interest rates decision and AUD valuation. The stats bureau uses the forward factor method, ensuring that the seasonal factors are not distorted by COVID-19 impacts.